Representing Chargebacks

Contacting the Shopper

Upon receiving a chargeback, you might consider contacting the shopper, as the chargeback may have been a mistake (e.g., the shopper did not recognize the statement descriptor on their statement). If the shopper does agree to withdraw their dispute, you must still respond to the chargeback by letting the card issuer know that the shopper acknowledged that the payment was valid. Provide written or photographic proof that you resolved the dispute directly with the customer. An email or letter from the customer stating they no longer wish to contest the transaction is an example.

Even if you contact the shopper and both parties arrive at a resolution, as the merchant you must respond to the chargeback.

Prepare a Response with Relevant Evidence

In preparing your response, include as many of the attributes listed below as possible. The response should be concise (maximum of 10 pages), relevant to the chargeback reason code, and professional. Keep the most pertinent identifying information (shopper name, address, purchase details etc. ) at the beginning of the response.

Customer and Device Details

- Customer: First or Last Name, Email Address, Billing or Shipping Address, Phone Number

- Device Details: IP Address, IP Location, Model, and any other device identifying information. Establish a clear connection between the IP address associated with the transaction and the IP address associated with the user account and their usage history. For digital products or services, you do not need to include the entire usage history for every customer. Proof of usage after the charge and before the dispute should be sufficient in most cases where the reason code warrants it.

Product and Delivery Details

- Product description and type: physical, digital, offline service.

- Fulfillment: Tracking information (if physical product) and delivery confirmation (if physical product)

Payment Details

- Type of payment: One-time payment or subscription payment

- Transaction Details: Transaction amount and date, currency, dispute date, order number/ transaction ID, digital download number, refund status (full, partial)

- Authorization details: AVS match code, CVV match code, authorization ID, signed contracts

- Payment method: Last 4, expiration date, card type

Other Supporting Evidence

- Merchant domains

- Order history (proof of previous non-disputed payments)

- Proof of customer communication/attempt to resolve prior to the dispute

- Web images (click to accept T&C)

- Terms and Conditions

- Proof of usage

Make the Evidence Easy to Review

Include screenshots of evidence (delivery service tracking information and relevant portions of Terms and Conditions) directly in your response, as card issuers are more likely to review evidence embedded within the response. Card issuers do not typically navigate to links that present evidentiary documents or images.

Some issuers use older technologies to access and review responses, so be sure that any screenshots, images, or text you include are clear enough for the reviewer to determine if they print your representment on paper. Here are some tips:

- Do not include links. Issuers will not click links included in representments. Take screenshots to illustrate what shoppers have on your website.

- Use a 12-point sans serif font.

- Images should fit on a printed page and always be black and white, never color.

- Keep your response succinct. Issuers might not review everything you submit if your response is too long. Try to keep your representment document under 15 pages.

- Emphasize pertinent information with formatting (e.g., bold, underline, or italics).

- Call out compelling evidence on your first page (consider it a cover letter). For example:

|

Wilma's Bar and Grill sells high-quality brontosaurus burgers at hard-to-beat prices. Our website is "www.wilmas-bar-and-grill.com," and our statement descriptor is WILMA_8889997654.

|

Prove the Product was Delivered

If the shopper believes the product they ordered was never delivered, you should include artifacts proving the goods were delivered. This can include tracking information from the delivery service, images of the house the goods were delivered to, and the full shopper address. Also include any type of correspondence where the shopper acknowledges delivery of the product, like emails, text messages, or social media messages.

Demonstrate that the Shopper Made the Purchase

Collect and include attributes demonstrating that the cardholder did make the purchase such as Card Verification Code (CVC) confirmation, Address Verification System (AVS) checks, Signed Receipts/ Contracts, IP Address, and Billing Address matches.

If the shopper violated your terms and conditions, include screenshots of the section of the terms and conditions they violated and the manner in which you display them.

Include any attempts your customer service team has made to clear things up with the customer before they initiated a chargeback, if possible. Include any communication your customer service team has had with the customer about their account or the disputed charge.

Proof of usage before and after the charge, including a history of undisputed successful transactions, can be helpful.

Specific Artifacts to Include for Each Chargeback Reason Code

The evidence you submit in your representments should be tailored to the specific chargeback reason code that the shopper indicated. The links for each card brand below provide the evidence merchants should consider including. The evidence varies by reason code, card brand, and product type.

Chargeback Response Template

Merchants can use the Chargeback Response Template to guide them through creating their own chargeback response. Download and share the template with your clients.

Recommendations Based on Card Brand, Product Type, and Reason Code

We use these terms to indicate the level of importance for each of the different types of evidence.

- Crucial: This information is critical to the success of your chargeback representation and will not succeed unless this evidence is comprehensively and thoroughly provided. Visa refers to this as “compelling evidence”. Compelling evidence is proof the cardholder participated in the transaction, received the goods or services, or benefitted from the transaction. It allows merchants or acquirers to provide additional types of evidence to try to support that the cardholder participated in the transaction, received goods or services, or otherwise benefited from the transaction.

- Required: This information should always be included in your submission

- Recommended: If this information is available, it will help your submission

- Optional: While not strictly necessary, if the information is available, it will not harm your submission

These recommendations are best practices based on BlueSnap’s experience of chargeback management. Individual cases will vary depending on the issuer and their interpretation of the chargeback, and are ultimately governed by the card scheme rules.

Chargeback reason codes

Walkthrough Using the Chargebacks911 Case Builder

- Using the options to the left of the screen, navigate to Chargebacks and select Case Management.

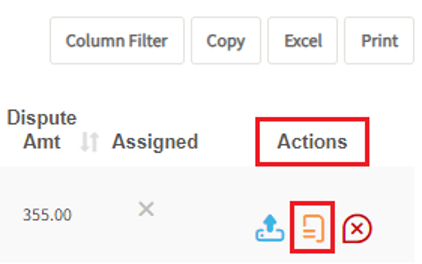

- To respond to a new chargeback, click on New tab and select Case Builder from the Actions options on the right of the screen.

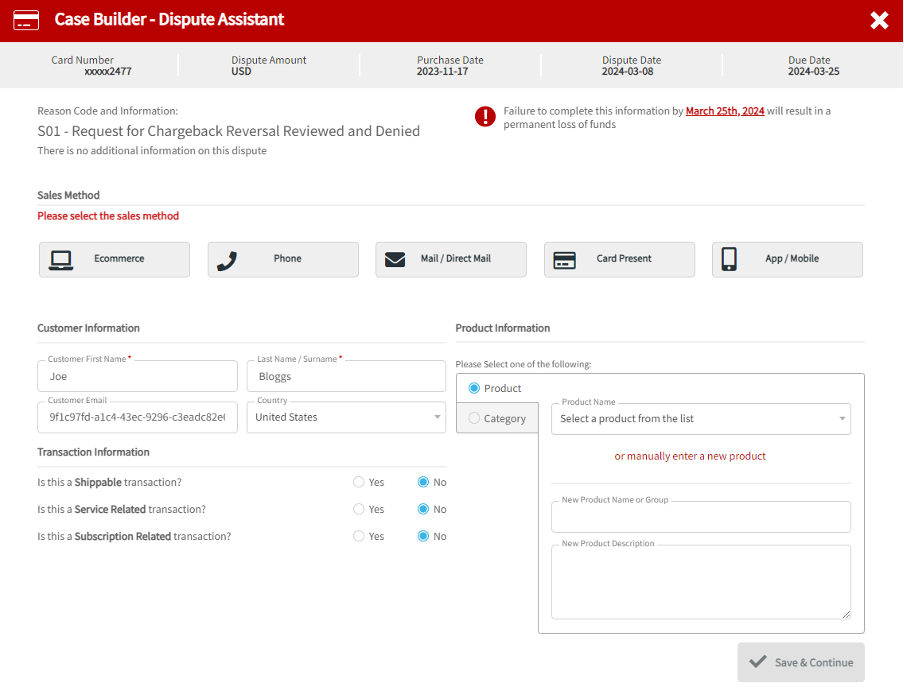

- Choose the sales method, fill in the customer information fields, and then make the appropriate choices from the Product Information section. You can choose a pre-defined category or product type or create a custom product type.

- The transaction information section indicates whether the product is a physical good (shippable transaction), a service, or a subscription-related product. If your product fits none of these descriptions, leave them all set to No. Click Save & Continue .

- To the best of your ability, complete each field of the Purchase Details, Billing Details, Customer Details, Web Details, Shipping Details, and Additional Details sections. Including all these data points will help ensure you have the best odds of winning the chargeback. Click Save & Continue.

- Upload any additional documentation that could be evidence that the chargeback is invalid. Each chargeback reason code has different required or recommended evidence. (Refer to Recommendations Based on Card Brand, Product Type, and Reason Code). You should upload all documents in JPG format. Individual files should not exceed 2MB. The maximum total size must be 10MB or less. Choose the document type from the options. Click Save & Continue .

- Look over the Case Summary to ensure all the displayed data is correct. Click Save & Continue.

You should be 100% sure you have provided all the evidence before clicking the Submit Representment button because this is the last opportunity you have to submit any documentation supporting your dispute.

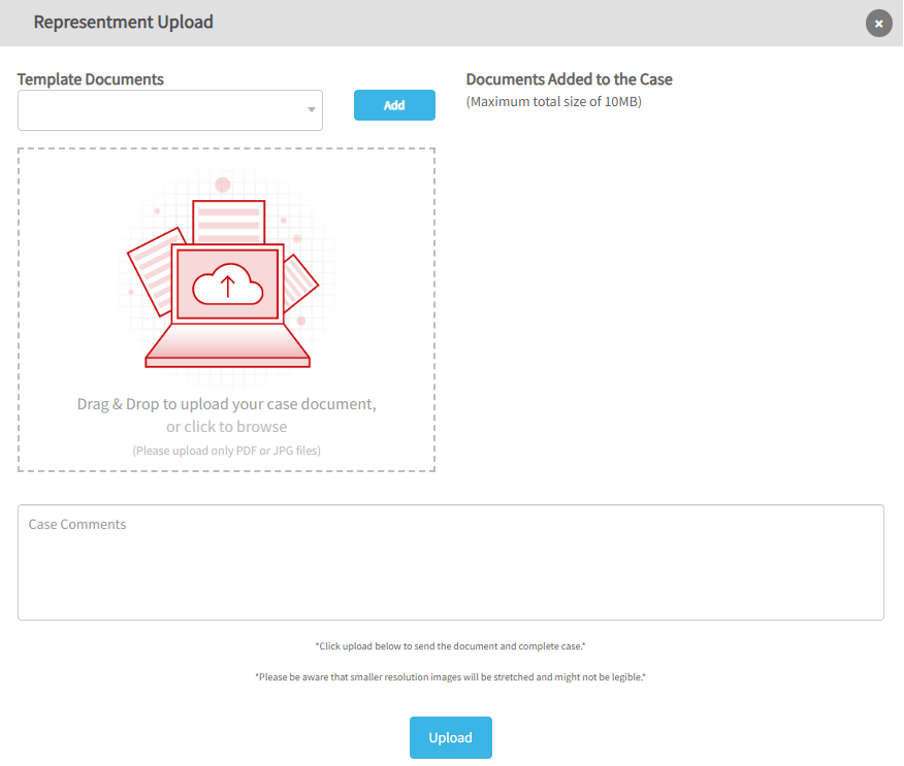

Walkthrough Using Chargebacks911's Uploader

- Using the options on the left of the screen, navigate to Chargebacks and then select Case Management.

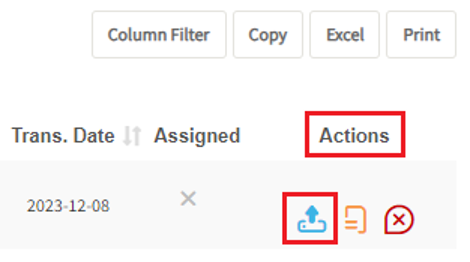

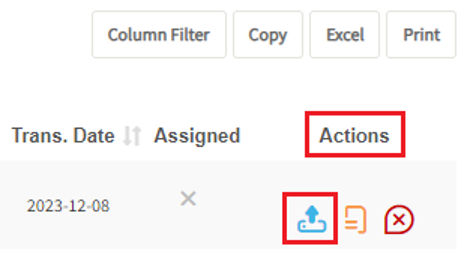

- To respond to a new chargeback, click on New tab and select Upload Representment from the Actions options on the right of the screen.

- Build your response using the best evidence you have. Use BlueSnap's Chargeback Response Template and Recommendations Based on Card Brand, Product Type, and Reason Code.

- Drag and drop your response document(s) or click the upload icon to browse files on your computer (maximum total size must be 10MB or less).

- Check to be sure your file(s) uploaded successfully.

You should be 100% sure you have provided all the evidence before clicking Submit Representment because this is the last opportunity you have to submit any documentation supporting your dispute.

Be sure that response is correct and complete before clicking Upload to send the document. You cannot un-send documents once you click this button.

Chargeback Representment Upload API

If an API meets your needs better, you can use our Chargeback Representment Upload API request.

Updated 4 months ago