Dispute Prevention and Resolution Services

BlueSnap partners with two leaders in the chargeback prevention industry, Ethoca and Verifi, to manage alerts and resolution tools on your behalf. BlueSnap has seamlessly integrated them into our payments workflow and reporting capabilities, helping our merchants reduce fraud and chargebacks.

There are 2 types of tools:

- Prevention tools provide notice of a card issuer’s intention to initiate a chargeback due to suspected fraud and/or a cardholder-initiated dispute. These tools allow merchants to automatically relay transaction details back to the cardholder/issuer to help cardholders recognize purchases, reduce payment disputes from friendly fraud, and reveal policy abuse.

- Dispute resolution tools provide the merchant with an opportunity to resolve a dispute before it becomes a chargeback. There is no guesswork because these alerts are cardholder-confirmed disputes or fraud. When the associated transaction is refunded, the issuer is notified that the charge associated with the disputed transaction has been resolved and this mitigates the chargeback. These tools can perform actions on behalf of the merchant/seller so disputes can be resolved with the cardholder before a chargeback occurs.

All merchants are encouraged to enroll in these services as a preventative measure against fraud and chargebacks. To sign up for any of the services indicated below, please contact your BlueSnap account representative or email our customer service team at [email protected]. We will review your account and recommend the alert services that will benefit you the most.

Prevention Tools

Order Insight

Visa cards only.

Order Insight is a Visa dispute prevention tool that allows merchants to automatically return enhanced order details when customers contact their banks, preventing potential chargebacks. Order Insight reduces merchants’ Visa chargeback counts and can help keep them out of Visa’s excessive chargeback program.

When merchants use Order Insight and a dissatisfied shopper reaches out to their bank to dispute a charge, BlueSnap receives an inquiry from the issuer. BlueSnap responds to the issuer with enhanced order details in real-time, reminding the shopper what they bought and where they shopped. Ideally, the dispute doesn't go any further. A merchant not using Order Insight might get a chargeback and all the associated headaches.

Still have questions? Check out our Order Insight FAQs.

Resolution Tools

Chargeback Prevention Alerts

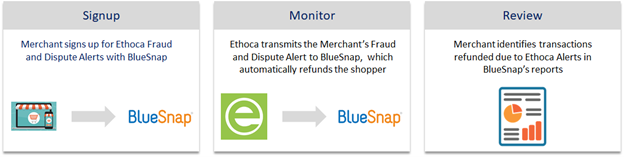

Ethoca's Fraud & Dispute Alerts, and Verifi’s CDRN Alerts are excellent solutions to reduce chargebacks by intervening early in the dispute process to prevent them. Verifi and Ethoca collect disputes from participating card issuers and provide them directly to BlueSnap. This takes considerably less time than the conventional process that relies on card networks to transmit disputes to merchants.

After merchants sign up for these services, BlueSnap is notified of impending disputes, and we immediately refund the shopper for the full amount of the payment. Merchants may view any refunds issued on Ethoca or Verifi alerts directly from their BlueSnap reports. Refer to the reporting section below.

Key Differences Between Ethoca and Verifi

Descriptors

Ethoca and Verifi have different methods for matching descriptors to businesses:

- Ethoca: Ethoca's technology looks for descriptors that start with a text string or descriptors that are an exact match between the disputed transaction and the merchant's billing descriptor.

- Verifi: Verifi's platform looks for an exact match between the disputed transaction and the merchant's billing descriptor or the customer service number associated with the merchant's descriptor.

Reason Codes

- Ethoca: Alerts were initially designed to focus solely on criminal fraud but have evolved over the years to include fraud and consumer disputes. For this reason, Ethoca's system is not geared to provide reason codes.

- Verifi: Alerts were created to cover disputes associated with both fraud and non-fraud reason codes. Their system provides reason codes.

BINs

Practically all major banks participate in both Ethoca and Verifi programs. Banks have numerous unique bank identification numbers (BINs) to categorize the various types of accounts, card brands, cardholder risk, and more.

Some issuing banks have chosen to participate fully in both programs. Some have opted to enroll a selection of their BINs exclusively with either Ethoca or Verifi, or they have chosen not to enroll in either program. For this reason, neither Ethoca nor Verifi can guarantee you will be alerted to all incoming fraud or disputes.

Coverage

Ethoca and Verifi provide alerts for most major card brands, with some key differences:

- Ethoca : more comprehensive coverage for Mastercard accounts and a sizeable portfolio of global BINs.

- Verifi: more extensive portfolio of Visa accounts and focuses mainly on US BINs.

Your Strategy

Your approach to prevention solutions should depend on your customers and the types of chargebacks you receive.

BlueSnap encourages you to:

- Use only Verifi if most of your chargebacks are non-fraud reason codes and you sell to a mostly US customer base.

- Use only Ethoca if most of your chargebacks are fraud reason codes and you sell to customers all around the world.

- Use both Ethoca and Verifi if your chargebacks are a combination of both fraud and non-fraud reason codes, and you want the most comprehensive protection possible.

BlueSnap will request a credit for any duplicates, or for alerts that don't stop chargebacks.

Still have questions? Check out our Chargeback Prevention Alerts FAQs.

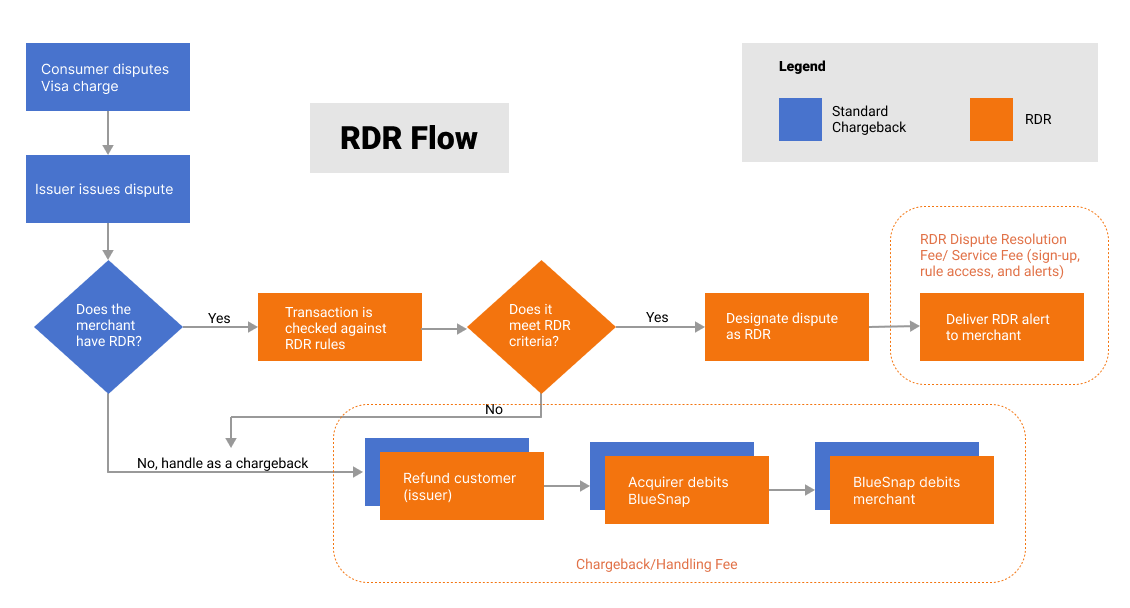

Rapid Dispute Resolution (RDR)

For Visa cards only.

Rapid Dispute Resolution, or RDR, is Visa's chargeback resolution tool. It offers merchants the ability to resolve disputes before they become chargebacks by triggering an immediate, automatic refund to the shopper. RDR reduces merchants' Visa chargeback counts and can help keep them out of Visa's excessive chargeback program. Whether or not your MIDs are boarded through BlueSnap, we can support RDR for all of your accounts.

BlueSnap is your exclusive source for receiving email notifications of each RDR case. You’ll receive RDR notifications from BlueSnap to help resolve disputes quickly. Best of all, refunds will be handled automatically by your customers’ issuing banks and Visa. BlueSnap will facilitate your enrollment, provide reporting, and email notifications of each RDR case for all of your MIDs.

RDR Flow

Follow the flowchart below to understand the RDR vs chargeback lifecycle.

Still have questions? Check out our RDR FAQs.

Order Insight and Pricing MCC Tiers

MCC Tier 1 is all MCCs not referenced in Tiers 2 or 3.

| MCC Tier 2 | MCC Tier 3 |

|---|---|

| 5045 (Computers and Computer Peripheral Equipment and Software) | 4816 (Computer Network / Information Services) |

| 5399 (Misc. General Merchandise) | 5122 (Drugs, Drug Proprietaries, Druggist Sundries) |

| 5499 (Misc. Food Stores - Convenience Stores and Specialty Markets) | 5816 (Digital Goods - Games) |

| 5734 (Computer Software Stores) | 5912 (Drug Stores, Pharmacies) |

| 5735 (Record Stores) | 5962 (Direct Marketing - Travel Related Arrangement Services) |

| 5815 (Digital Goods Books/Movies/Music) | 5966 (Direct Marketing - Outbound Telemarketing Merchants) |

| 5817 (Digital Goods App - Excludes Games) | 5967 (Direct Marketing - Inbound Telemarketing Merchants) |

| 5818 (Large Digital Goods Merchant) | 5993 (Cigar Stores and Stands) |

| 5964 (Direct Marketing - Catalog) | 6051 (Non-Financial Institutions- Foreign Currency, Non-Fiat Currency, Money Orders, Travelers Cheques and Debt Repayment) |

| 5968 (Direct Marketing - Subscription) | 7273 (Dating and Escort Services) |

| 5969 (Direct Marketing - Other) | 7995 (Betting, including Lottery Tickets, Casino Gaming Chips, Off-Track Betting, and Wagers at Race Tracks) |

| 5999 (Miscellaneous Specialty Retail) | |

| 7299 (Miscellaneous Personal Services not elsewhere classified) | |

| 7321 (Consumer Credit Reporting) | |

| 7399 (Business Services - Default) | |

| 8699 (Member Organizations - Default) | |

| 8999 (Professional Services - Default) |

Reporting

All transactions refunded due to the Ethoca and Verifi services listed above are included in your Refund Report.

Any refund with these descriptions has been refunded due to an alert:

- Ethoca Alert

- Verifi Alert

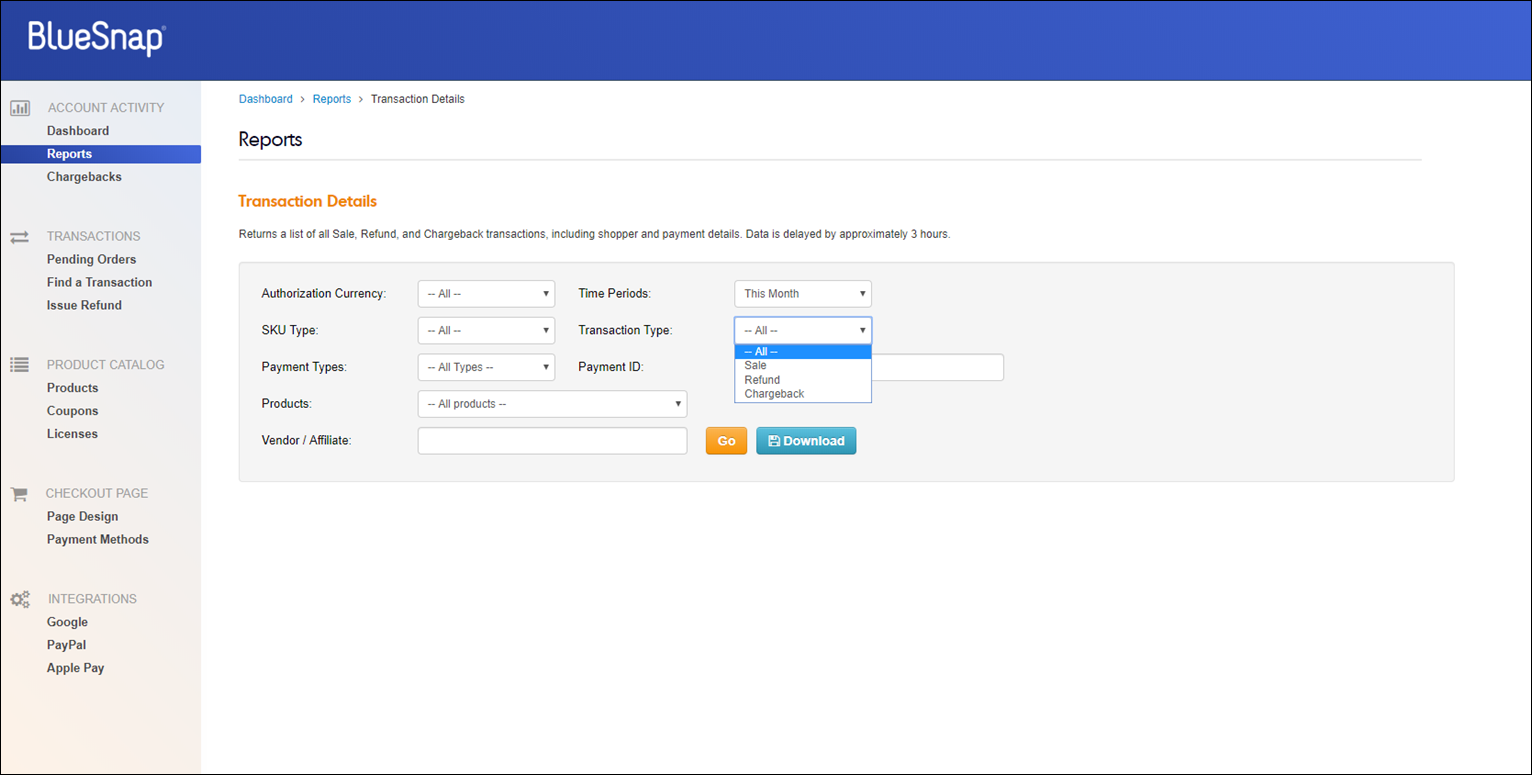

Accessing the Refund Report

The Refund Report is a sub-set of the Transaction Details Report.

To access the report and see refunds due to a fraud alert, follow these steps:

- In the BlueSnap Portal, click Reports near the top of the left navigation panel.

- Click Transactions and then choose Transaction Details.

- In the Time Periods field, select the time frame for the report.

- In the Transaction Details report setup page, click Transaction Type and select Refund.

- Click Go to view the report. Then, you can click the Download button to download the information in Excel format.

Webhooks

Webhooks provide up-to-date information on all transaction events in real-time. The following webhooks can help with chargeback and fraud:

- CHARGEBACK: Sent when a shopper challenges a transaction with their issuing bank, which initiates the chargeback process. This webhook provides you the opportunity to address the issue.

- CHARGEBACK_STATUS_CHANGED: Sent when an event is received from Chargebacks911 that does not open a new chargeback.

- REFUND: Sent whenever a refund is issued, including those stemming from prevention alerts and RDR.

For more information on webhooks, refer to the Webhook Overview.

Subscriptions

If you are using the BlueSnap Subscription Engine, we automatically refund the transaction and cancel the subscription.

Important

If you are a merchant with a recurring billing or subscription model and are using our merchant-managed on-demand subscription feature and if you are enrolled in the Fraud Transaction Alert Service, you must find these refunds and cancel the associated subscription.

Updated 3 months ago