Payout

BlueSnap sends the funds for all processed transactions to the payout method that you set up in the Merchant Portal. The payout you receive for a given period is a calculation of your sales minus any costs, such as transaction fees. BlueSnap allows you to include additional bank accounts for the option to receive regional payouts, as required for certain countries.

Your payout depends on the commercial terms of your agreement with BlueSnap. However, the default payout frequency is Daily +2 business days. BlueSnap can also potentially support multiple payout methods in 14 payout currencies. For the complete list, refer to the Like-for-like column in the Supported Currencies table. Note that fees vary by payment method. Refer to the Table of BlueSnap Fees under Settings > BlueSnap Agreement for details. You can also leverage the Payout Details Report for information about each payout, including sales, refunds, chargebacks, commissions, and more.

Setting up your payout method

- To set up the payout method, go to Settings > Payout Method in our Merchant Portal.

- Define the settings detailed in the table below.

- Once you finish, click Submit. Your changes take effect at the end of your current payout.

| Setting | Description |

|---|---|

| Bank Account Country | Select the bank account country to which funds are sent. |

| Payment Method | You can choose from one of the payout payment methods applicable to your country. |

| Payment Reference | Customize the reference text that appear on your bank statement for BlueSnap deposits. If left blank, the text is the standard message (i.e., "BlueSnap Payment {Payment ID} for Merchant {Merchant ID}"). |

| Minimal Payout Amount | This is the minimum amount for a payout. If any payout due is below the specified value, a payout is not created and the next payout includes the transactions that were not paid out. You can increase the minimum payout amount if necessary. Note: The default value is** 35.00 in USD** for USD and for any currency not listed below. For the currencies listed below, the default value is specified in that currency.AUD, CAD, and NZD: 50.00 CHF, EUR, and GBP: 35.00 CZK: 800.00 DKK: 250.00 HKD, NOK, and SEK: 300.00 HUF: 10,000.00 JPY: 3,700.00 |

| Refund Operating Account | Account with funds that are set aside (not paid out) to enable you to issue refunds even when your account balance is low. Your refund operating account balance accrues from sales, and once your refund reserve amount is met, all additional sales are applied to your next payout. Learn more. |

| Account Details | Provide account information for your chosen payment method. |

Payout Details by Country: Timing, Currencies, and Payment Reference Support

Use this table to confirm the payout payment types, payout timing, payout currencies available in a country, and whether BlueSnap will appear on the merchant’s bank deposit for payout.

BlueSnap can appear on a bank deposit in either the Payment Originator or Payment Reference field:

-

Payment Originator Field — Identifies the originator of the payment file. This field is populated by BlueSnap and must contain BlueSnap in most cases due to banking regulations. In some cases, the Payment Originator Field displays the contents you put in the Payment Reference Field. Refer to the table below. The bank where the merchant account is located controls whether or not this field is displayed.

-

Payment Reference Field — Text field that you can populate. This text field is available for most payout payment types. Refer to the table below.

If you don’t populate this field, the default value will be: "BlueSnap Payment for Merchant {Merchant ID}".

If the Payment Reference field is unavailable for the payout payment type, nothing will display on the bank deposit, not even the default value.

| Payment Processing Country | Supported Settlement Currency | Merchant Receiving Bank Country | Payout Payment Type | Payout Timing | Payment Originator Field | Payment Reference Supported |

|---|---|---|---|---|---|---|

| Australia | 3 business days after payment occurs | |||||

| Australia | AUD | AU | BECS | BlueSnap | Yes* | |

| Australia | AUD | AU | Wire | BlueSnap | Yes* | |

| Australia | AUD | Outside AU | Wire | BlueSnap | Yes* | |

| Australia | USD, NZD | All | Wire | BlueSnap | Yes* | |

| Canada | 3 business days after payment occurs | |||||

| Canada | CAD | CA | PAD | BlueSnap | No | |

| Canada | CAD | CA | Wire | BlueSnap | Yes* | |

| Canada | CAD | Outside CA | Wire | BlueSnap | Yes* | |

| Canada | USD | All | Wire | BlueSnap | Yes* | |

| Canada | USD | CA | PAD | BlueSnap | No | |

| European Union | 4 business days after payment occurs | |||||

| European Union | EUR | EU | SEPA | BlueSnap | Yes* | |

| European Union | EUR | EU | Wire | BlueSnap | Yes* | |

| European Union |

|

All | Wire | BlueSnap | Yes* | |

| Israel | 7 business days after payment occurs | |||||

| Israel | ILS | All | Wire | BlueSnap | No | |

| Israel | EUR | All | Wire | BlueSnap | No | |

| Israel | USD | All | Wire | BlueSnap | No | |

| Norway | 4 business days after payment occurs | |||||

| Norway | NOK | Wire | ||||

| Sweden | 4 business days after payment occurs | |||||

| Sweden | SEK | Wire | ||||

| Switzerland | 4 business days after payment occurs | |||||

| Switzerland | CHF | Wire | ||||

| United Kingdom | 4 business days after payment occurs | |||||

| United Kingdom | GBP | UK | FAST | BlueSnap | Yes* | |

| United Kingdom | GBP | UK | CHAPS | Contents of Payment Reference Field | Yes* | |

| United Kingdom | GBP | UK | Wire | BlueSnap | Yes* | |

| United Kingdom | EUR | EU | SEPA | BlueSnap | Yes* | |

| United Kingdom | EUR | EU | Wire | BlueSnap | Yes* | |

| United Kingdom |

|

|

FAST | BlueSnap | Yes* | |

| United Kingdom |

|

All | Wire | BlueSnap | Yes* | |

| United States | 2 business days after payment occurs | |||||

| United States | USD | US | ACH | Contents of Payment Reference Field | Yes* | |

| United States | USD | US | Wire | Contents of Payment Reference Field | Yes* | |

| United States | USD | Outside US | Wire | BlueSnap | Yes* |

*Although the contents of the payment reference field can be passed, whether or not it’s displayed on the deposit is controlled by the bank where the merchant account is located.

Other Payout Methods

Payout to a Payoneer Account

Payoneer enables merchants with accounts domiciled outside the US to receive funding in USD. To get started with this option, you must sign up with Payoneer to get your receiving account details. You then need to enter these account details in your Merchant Portal by selecting ACH for your USD payout configuration.

To determine what value to enter in the Bank Account State field, follow these steps:

-

In your Payoneer account, go to the Global Payments section, which contains the details of the US bank account provided by Payoneer.

-

Locate the name of the bank to determine what value to enter in BlueSnap.

- If the bank name is Bank of America, enter New York in BlueSnap.

- If the bank name is First Century Bank, enter Georgia in BlueSnap.

Note

If the bank name is not one of the above values, contact your Implementation Specialist and provide them with the bank's routing number. They will give you the value to enter in BlueSnap.

Wire Transfer

Wire Transfer is available for accounts domiciled in any of our supported countries. Select this option to receive your funds in 1 business day.

Provide all relevant information; your recipient bank can assist. If an intermediary or correspondent bank is used, this additional information should also be completed.

Webhooks and Email Notifications

Payout Webhook

An Webhook is sent each time BlueSnap issues a payout (deposit). If a merchant has more than one payout currency, we generate a single PAYOUT webhook that includes all currencies.

Failed Payout Transfers Webhook and Email Notification

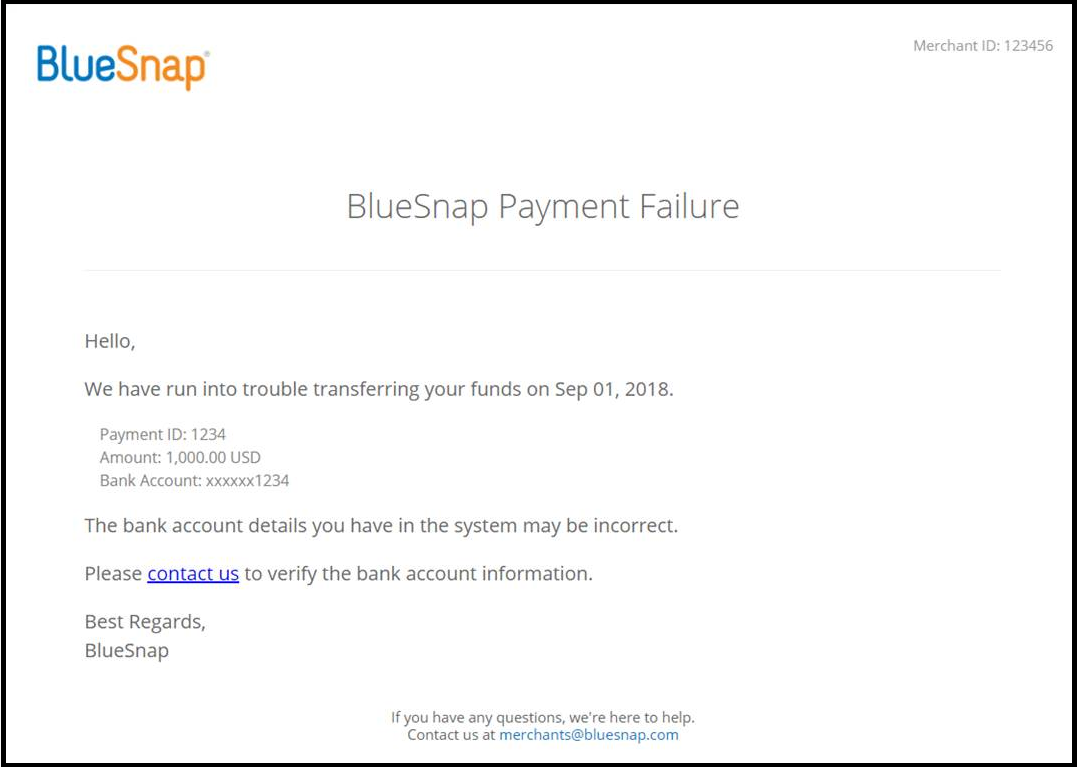

BlueSnap can send you a notification for a failed payout transfer if you enable the Failed Payout Transfer webhook. If enabled, an email notification (refer to example below) and an webhook, FAILED_PAYOUT_TRANSFER will be sent to affected merchants.

Email Notification Example

Send to: Accounting Email Address + Admin Email Address

Subject: BlueSnap Payment Failure

Body:

Regional Payouts

For compliance reasons related to Brexit, your deposits will potentially be split by processing region (e.g., EU, UK, US). This means you will receive one or more additional deposits than you might have traditionally come to expect. While you may receive multiple payout deposits, there will be no impact to your transaction processing. All transactions continue processing through our global network of local acquiring banks using our Intelligent Payment Routing, helping you to increase sales and reduce costs.

When you are receiving multiple deposits it can get tricky to keep track of your payout. To address this, we have added a region column to our reports. If you match your BlueSnap reports to your BlueSnap deposits, you need to refer to the region column to match your region to your deposit.

Note

You may have additional fees, such as bank fees charged by intermediary banks used to facilitate payment between our bank and your bank, or foreign exchange fees.

Reporting

BlueSnap has introduced region as a selection criterion in reporting. If you are using multiple legal entities to process with BlueSnap, these report changes allow you to generate reports by your legal entity and match the deposits you receive from BlueSnap.

If you use the BlueSnap Merchant Portal for reporting, the reports will show region as a new report criterion option, and your report results will contain region.

Updated 3 months ago