About Chargebacks

Common Reasons for Chargebacks

Shoppers' issuing banks will categorize every chargeback with a reason. Here is an overview of the most common chargeback reasons. Banks use codes to represent these reasons, and each card brand uses different codes. You can read more about all the card brands' chargeback reason codes here .

Fraud

Fraud is the number one chargeback reason, but it is important to note that there are two types of fraud:

- True Fraud : The purchase was not made or authorized by the legitimate cardholder due to identity theft, credit card theft, scams, or other fraudulent activity of which the cardholder is the victim.

- Friendly Fraud (AKA False Fraud, Family Fraud, First-Party Fraud) : Friendly fraud occurs when a shopper (or authorized party) makes a legitimate and authorized purchase but then files a chargeback falsely claiming it as fraud. Sometimes, a shopper may inadvertently commit friendly fraud by not fully understanding the process of obtaining a refund and opting to file a chargeback.

Processing Errors

An example of a processing error is that the shopper was charged twice for the transaction, or they feel the merchant charged the wrong amount.

Merchandise or Services Not Received

If shoppers believe they did not receive the purchased product, goods, or services, their banks will apply this reason to the chargeback.

Canceled Recurring Charges

Shoppers may find it easier to contact their banks instead of reaching out to the merchant about canceling their subscriptions or trials, and the banks may use this chargeback reason to force the merchant to cancel the agreement with their shoppers for the recurring charges. Visa is taking action to put an end to this. Learn more.

Merchandise or Services Not as Described or Defective

If shoppers believe what they received is not what they bought, or if the goods are defective, issuers will apply this reason code to the chargeback.

Credit Not Processed

This reason is used by banks when shoppers haven't received a promised credit or refund.

The Chargeback Process

After a shopper contacts their issuing bank to contest a transaction, the issuing bank submits the case to the merchant's bank as a retrieval request or a chargeback.

Retrieval Requests

Before creating a chargeback, shoppers' card issuing banks sometimes send inquiries or retrieval requests to merchants' banks. These requests for detailed information about a transaction can remind shoppers (and their banks) about transactions they just might have forgotten about or don't recognize because the merchant's statement descriptor doesn't clearly identify their business. American Express refers to these requests as Requests for Transactional Information (RTI) and Discover refers to them as Transaction Retrieval Requests (TRR).

Visa and MasterCard replaced retrieval requests with their respective products, Order Insight and Consumer Clarity. Learn more .

There is no money movement at the retrieval request stage. There are no fees associated with retrieval requests, and they do not count against a merchant's chargeback ratio. A response to a retrieval request doesn't guarantee that a chargeback will not occur, but it might stop a chargeback. Not responding to a retrieval request might impact the merchant's rights to contest a chargeback.

Chargebacks

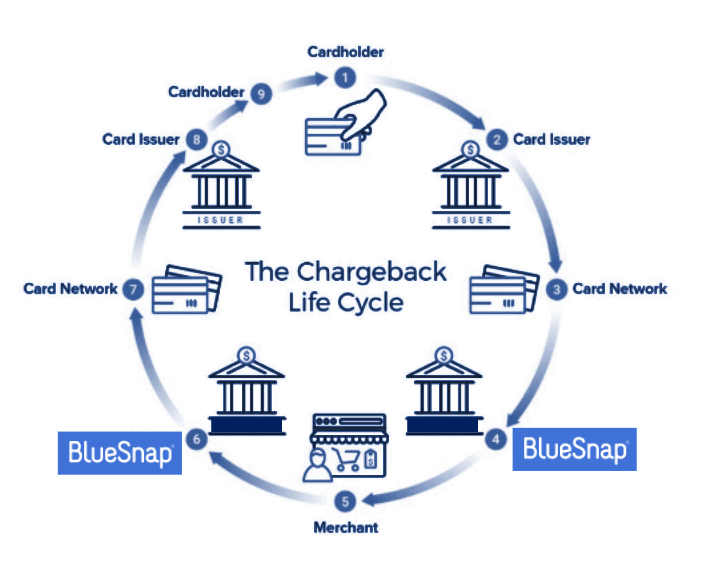

Issuers may create a chargeback immediately after a shopper files a claim or after the issuing bank conducts a retrieval request. The basic chargeback flow is as follows:

- A shopper requests a chargeback: A customer contacts their issuing bank and contests a particular purchase, requesting a chargeback.

- The issuing bank credits the shopper: Once the issuer creates the chargeback, they will credit the shopper the chargeback amount

- The issuer notifies the appropriate card network of the dispute.

- The card network notifies BlueSnap of the dispute.

- BlueSnap notifies the merchant of the chargeback: The issuing bank and card network inform BlueSnap that a shopper has requested a chargeback on a purchase. BlueSnap debits funds from the merchant and notifies them of the chargeback via email or a webhook.

- The merchant responds to the chargeback (2 options):

a. Accept the chargeback: The merchant may agree that the shopper's claim is valid and, by taking no action on the chargeback, allow the shopper to retain the funds.

b. Fight the chargeback: The merchant may believe that the shopper's claims are unfounded and that they have enough evidence to prove it, so they choose to represent or fight the chargeback by using BlueSnap's chargeback management services. - The merchant's representment is transmitted through the appropriate card network to the issuing bank.

- The representment is reviewed by the issuing bank.

- The issuing bank delivers its verdict and notifies the card network: The issuer will review the merchant's evidence (representment) and determine whether it is sufficient to overturn the chargeback.

- Win: The issuer accepts the merchant's reasoning in their representment, the chargeback is reversed, and the merchant's funds are returned.

- The issuing bank can still decide to pursue the dispute further, taking it into pre-arbitration (more on this below):

- If a chargeback in pre-arbitration is decided in the merchant's favor, BlueSnap will return the disputed amount to the merchant's account.

- If a chargeback in pre-arbitration is decided in favor of the cardholder, the cardholder will retain the funds.

- The issuing bank can still decide to pursue the dispute further, taking it into pre-arbitration (more on this below):

- Loss: The issuer upholds the chargeback, allowing the shopper to retain the funds.

- Win: The issuer accepts the merchant's reasoning in their representment, the chargeback is reversed, and the merchant's funds are returned.

- The cardholder and the merchant are made aware of the final outcome of the dispute.

Pre-Arbitration (previously known as Second Chargebacks)

The above flow outlines the first chargeback scenario. In Step 9, if the issuing bank continues the dispute, the chargeback lifecycle continues into the pre-arbitration process.

After a merchant responds to a chargeback, the issuer will review the evidence and determine whether it is sufficient to overturn the chargeback. If the chargeback is decided in the merchant's favor, the funds are returned to the merchant, but the issuing bank has the right to file a pre-arbitration (formerly second chargeback) for the same transaction under certain circumstances.

For example, Visa allows the issuer to make a pre-arbitration attempt if any of the following are true:

- The issuer can provide new documentation or information to the merchant's bank about the chargeback.

- The issuer changes the chargeback reason after receiving the chargeback response.

- The issuer might change the chargeback reason only if the chargeback was valid.

- If the merchant proved that the cardholder no longer disputes the transaction, but the issuer disagrees

And a Visa issuer may pursue pre-arbitration under the same chargeback reason if both of the following are true:

- After the issuer initiated the dispute, the merchant issued a credit for the whole transaction amount in the merchant's local currency.

- The issuer suffered a financial loss due to the exchange rate difference between the credit and the chargeback response amount.

When BlueSnap receives notification of a pre-arbitration, we debit the funds from the merchant's account, and the shopper is credited again, pending the issuing bank's final decision. Since responding to a pre-arbitration may result in high fees if the merchant loses and the likelihood of a merchant winning is low, BlueSnap does not recommend or support merchants responding to chargebacks in pre-arbitration/second chargebacks.

Updated 4 months ago