Payment Processing 101

Learn the fundamentals of card transactions and how they are processed

When a customer submits their order, these steps occur to finalize the transaction:

- Authorization: Initial stage of a transaction where the cardholder’s bank validates that the card is legitimate and there are sufficient funds in the account. At this point the bank may accept or decline the transaction. If accepted, the funds are placed on hold, awaiting the next step: Settlement.

- Settlement: For each of those transactions that are accepted, a settlement transaction is sent along in order to move money from the cardholder’s bank to a merchant account held for you and then to your bank account. After this happens, the transaction is considered as Settled.

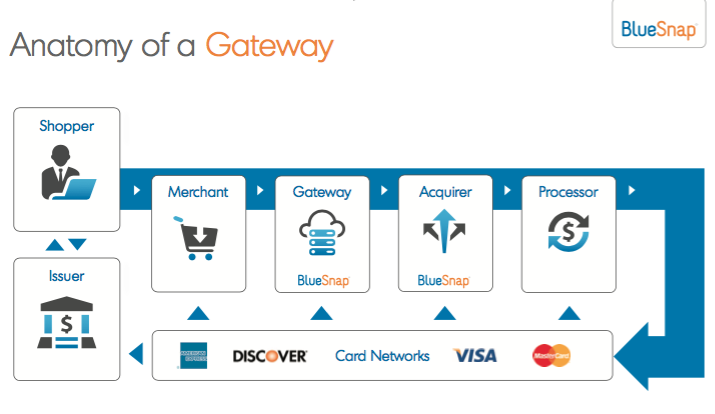

Who is involved in a transaction?

- Issuer: Issues the credit/debit card.

- Acquirer: An acquiring bank (or acquirer) is a bank or financial institution that processes credit or debit card payments on behalf of a merchant.

- Payment Gateway: Enables the payment. The gateway is a service to help merchants initiate payments for processing and is not directly involved in the money flow

- Processor: Payment processors are the financial institutions that work in the background to provide the core payment processing services used by an online merchant. These core processing services include authorization and refunding of transaction requests. Payment processors usually have partnerships with other companies, such as BlueSnap, who directly deal with merchants to handle all the processing needs.

- Merchant: Business receiving card payments.

- Cardholder: The shopper.

For a complete list of terms, refer to the Payments dictionary.

Updated 4 months ago