SEPA Direct Debit

SEPA (Single Euro Payments Area) Direct Debit is a popular European banking payment method that simplifies cross-border shopping in Euro. It is an online payment method where money is electronically withdrawn from the shopper’s bank account and then deposited into the merchant’s own bank account. SEPA Direct Debit transactions are monitored by our built-in fraud prevention capabilities, just like credit card transactions.

Supported Currencies

Euro (EUR)

Supported Shopper Countries

- Andorra

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Guernsey

- Hungary

- Holy See (Vatican City State)

- Iceland

- Ireland

- Isle of Man

- Italy

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Mayotte

- Monaco

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Saint Pierre and Miquelon

- San Marino

- Slovak Republic

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom

SEPA Direct Debit Transaction Processing

These are the main steps involved in processing SEPA Direct Debit transactions:

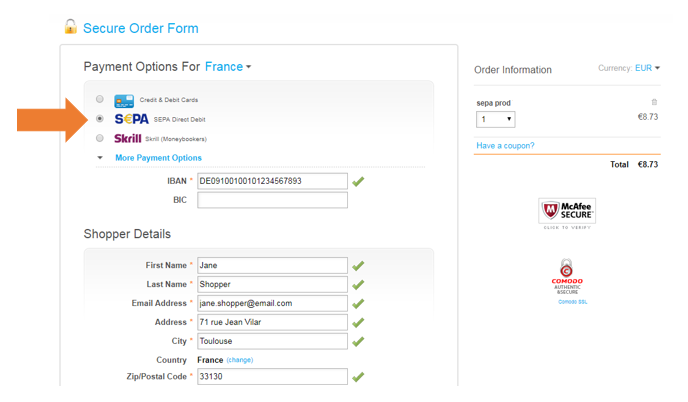

- Shopper selects SEPA Direct Debit and provides IBAN and account holder information.

- Shopper accepts the mandate authorizing their account to be debited and submits payment.

Chargebacks

If you receive a SEPA chargeback, the mandate selected by customers in Step 2 (above) can be provided as proof that a customer authorized a direct debit. Find more information about SEPA chargebacks below.

- The shopper gets redirected to a post-checkout page displaying order details and receives notification of the upcoming debit (an invoice in pending status is created).

- Within 6 business days, the shopper's account is debited (invoice status updates to approved), and the shopper receives notification of the successful debit.

Note

We recommend delivering the product only after you receive the approval.

SEPA Direct Debit in Hosted Pages

If you're using the Hosted Checkout page, contact Merchant Support and ask for SEPA Direct Debit to be enabled for your account.

Sandbox Testing

You may use the following IBANs to test various scenarios.

| IBAN | Transaction Status Result |

|---|---|

DE91100000001234400020 | from pending to success |

DE97100000001234400009 | from pending to fail |

DE78100000001234400060 | from pending to success to refunded |

Note: After the initial transaction request, the status change occurs within an hour.

SEPA Direct Debit in the BlueSnap API

If you're using the BlueSnap API, SEPA Direct Debit is available for you to implement in your website. For complete implementation details, refer to the API guide for SEPA Direct Debit.

Transaction Amount Requirements

The minimum transaction amount is 2 EUR, or the transaction is declined.

Subscriptions

BlueSnap supports subscriptions with SEPA Direct Debit. Note that subscriptions with SEPA Direct Debit do not support the following:

- Plans with a billing frequency of daily or weekly

- Trial periods

- Automated retries in BlueSnap's Subscription engine

- On-demand $0 transactions

Refunds

Refunds can be processed only after the shopper's account has been debited and the invoice status has changed to approved. Note that if you request a refund while the invoice is pending (before the shopper's account has been debited), you receive an error message informing you the transaction has not yet settled.

If a refund is requested after the shopper's account has been debited, BlueSnap removes the funds from your account and the invoice status updates to refunded.

Keep in mind that partial refunds and multi-partial refunds are not supported. If either is attempted, you will receive an error message.

You can issue a refund through the Merchant Portal or the Payment API. For details, see Issuing a Refund.

Chargebacks

Chargebacks can be requested by the shopper after the date on which their account was debited (i.e., debit date). The way chargebacks are handled depends on how long after the debit date the chargeback was requested.

Within eight weeks of debit date

Chargebacks requested within eight weeks of the debit date are automatically honored. This means that if a chargeback occurs within these eight weeks, the shopper's account is credited whether or not they accepted the SEPA Direct Debit mandate during checkout or they received any goods/services. BlueSnap removes the funds from your account and the invoice status updates to refunded.

Eight weeks to thirteen months of debit date

Chargebacks requested within the eight-week to the thirteen-month period after the debit date are reviewed by the shopper’s bank. The bank is provided with the details of the shopper’s SEPA Direct Debit mandate to consider as part of their decision. If the bank decides in the shopper's favor, then BlueSnap removes the funds for your account and the invoice status updates to refunded.

After thirteen months from debit date

Chargebacks cannot occur after thirteen months from the debit date.

Updated 3 months ago