Dispute and Fraud Monitoring Programs

Excessive Chargeback Monitoring Program

Excessive Chargeback Monitoring Program (ECMP) is BlueSnap's excessive chargeback (CB) monitoring program, which acts as an early warning system, alerting merchants to higher chargeback volumes. The program ensures merchants have time to implement changes before they meet or exceed the card brands' excessive chargeback thresholds (more on these thresholds below). Qualification in the card brands' excessive chargeback programs can result in fines and potential account closure over time. BlueSnap wants to help keep our merchants' accounts healthy and out of trouble with card brands.

ECMP Overview

BlueSnap places merchants who meet or exceed both thresholds in our ECMP program:

| Chargeback Count | Chargeback Ratio |

|---|---|

| 75 or more | 0.65% or more |

Chargeback counts and ratios are determined at the MID level monthly, considering all card types. If a merchant's chargeback ratio meets or exceeds 0.65% and they have 75 or more chargebacks in a month, they enter the ECMP program, and BlueSnap enrolls their descriptors in Verifi/Ethoca chargeback prevention alerts.

Merchants that continue in the program after the first month will have their chargeback fees increased each month. Merchants who continue in the program into the 4th month will be required to provide a remediation plan outlining the changes they intend to implement to decrease their chargebacks.

Program Exit Terms

Once the merchant's chargeback levels drop below ECMP thresholds for three consecutive months, increased chargeback fees are disabled. BlueSnap's chargeback team will continue to monitor the account closely, and the merchant's descriptors will remain enrolled in Verifi/Ethoca chargeback prevention alerts.

Card Brand Excessive Chargeback and Fraud Programs

Card brands have chargeback monitoring programs that track your dispute and fraud levels. If you meet or exceed the card brands' dispute or fraud thresholds, they will place you in a monitoring program. You may be charged fees or fines until your dispute or fraud levels return to an acceptable level. In a worst-case scenario, the card brands could decide to shut your account down.

Note

The following applies to all card brands listed below:

- All conditions must be met for a merchant to qualify for each of these programs

- Remediation plans are required

- A merchant will be released from each of these programs after 3 consecutive months of below-threshold activity

American Express Chargeback Program

American Express monitors the number of chargebacks and inquiries on its network. The program description detailed here is not exhaustive. American Express may place a merchant in one of its chargeback programs for reasons not listed here. At its sole discretion, American Express may place a merchant in any program at any time.

American Express Thresholds

Merchants are considered non-compliant in the American Express Chargeback Programs when they meet all the following criteria:

| Type of Threshold | Threshold |

|---|---|

| Monthly Net Chargeback | > 10 |

| Monthly Net Transaction | > 50 |

| Net-Chargeback-to-Net-Transaction Ratio | > 1% |

American Express may assess an Excessive Chargeback Fee for merchants who trend for three consecutive months. At that time, American Express will automatically enroll those merchants in the Excessive Chargeback Program. American Express will not assess a fee if any criteria are not met within a given month while enrolled in the program. Refer to the American Express Technical Specifications for further information regarding the Seller Dispute Program Notification File. American Express will remove merchants with a positive trend for three consecutive months from the Excessive Chargeback Program.

American Express Fraud Program

Merchants may be placed in this program for one or more of the following reasons:

- Merchant is classified in a high-risk category.

- American Express determines that the merchant's fraud-related chargeback volume is greater than 0.9% of the total American Express sales volume. If a merchant is placed on the Fraud Full Recourse Program, then such merchant must reduce its ratio of fraud-related disputes in order to be removed from the program and regain the ability to appeal these types of disputes. If a merchant maintains its fraud-related Disputed Charge volume below the 0.9% fraud to the gross threshold for a minimum of thirty (30) consecutive days, American Express, in American Express' sole discretion, may remove such merchant from the Fraud Full Recourse Program.

- Merchant engages or participates in fraudulent, collusive, deceptive, or unfair business practices, illegal activities, or prohibited uses of the American Express card brand.

MasterCard Chargeback Program

MasterCard's Excessive Chargeback Program (ECP) has two levels, the Excessive Chargeback Merchant Program (ECM) and the High Excessive Chargeback Merchant Program (HECM). These programs allow MasterCard to oversee e-commerce merchant activity and prevent excessive chargebacks on its network. If a merchant meets or exceeds the monthly threshold for chargebacks, MasterCard imposes penalties(fines) for non-compliance. They identify qualifying merchants by calculating basis points.

During an account's identification in ECM/HECM, MasterCard can begin charging applicable fines in month 2.

ECM/HECM Criteria

Merchants are considered non-compliant in the ECM / HECM categories when they meet the following criteria for both the number of chargebacks and the basis points in the following table:

| Monthly Criteria | Number of Chargebacks | Basis Points |

|---|---|---|

| ECM | 100 to 299 | 150 to 299 |

| HECM | 300 or more | 300 or more |

MasterCard calculates basis points by dividing a merchant's monthly chargeback volume by the sales volume from the previous month and multiplying the product by 10,000.

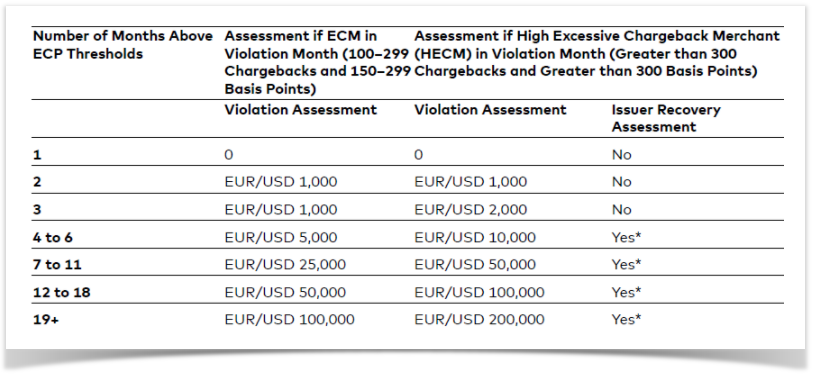

Violation Assessments and Fees (Fines)

Mastercard may assess fines starting in month 2 of ECP:

Issuer recovery assessment applies at EUR/USD 5 per chargeback over 300 chargebacks. For example, a merchant with 500 chargebacks would be assessed EUR/USD 1,000 in issuer recovery (500-300 = 200 x EUR/USD 5 = EUR/USD 1,000). A merchant's status in the MasterCard program does not reset as compliant until the merchant ID has achieved three consecutive months below the program thresholds.

Learn more about MasterCard's program and find their chargeback guide on their website.

MasterCard Fraud Program

MasterCard's Excessive Fraud Merchant Program (EFM) allows MasterCard to oversee e-commerce merchant activity by monitoring the total amount of fraud occurring as well as the number of transactions authenticated through EMV 3-D Secure (3DS) or Digital Secure Remote Payment (DSRP). If a merchant meets or exceeds the monthly threshold for fraud, MasterCard imposes penalties (fines) for non-compliance. They identify qualifying merchants by calculating basis points.

EFM Thresholds

Merchants are considered non-compliant in the EFM when they meet all four of the following criteria:

- The total dollar amount (or local currency equivalent) of fraud-related chargebacks is greater than or equal to EUR/USD 50,000

- The total number of fraud chargeback basis points (BPS) is greater than or equal to 50

- Merchant has at least 1,000 e-commerce transactions from the previous month in clearing.

- The percentage of monthly clearing volume processed using 3DS (including Identity Check Insights [IDCI] transactions) or DSRP is less than 10 percent in nonregulated countries or less than 50 percent in regulated countries

Violation Assessments and Fees (Fines)

Mastercard may assess fines starting in month 2 of EFM:

| Number of months above thresholds | EFM violation assessment amount |

|---|---|

| 1 | EUR/USD 0 |

| 2 | EUR/USD 500 |

| 3 | EUR/USD 1,000 |

| 4 to 6 | EUR/USD 5,000 |

| 7 to 11 | EUR/USD 25,500 |

| 12 to 18 | EUR/USD 50,000 |

| 19+ | EUR/USD 100,000 |

Learn more about MasterCard's fraud program on its website.

Visa Acquirer Monitoring Program

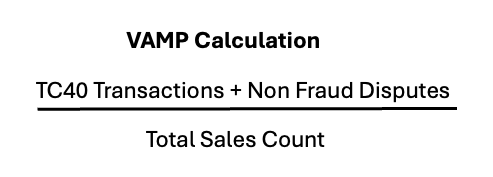

The Visa Acquirer Monitoring Program (VAMP) combines fraud and non-fraud chargebacks to take a look at the overall risk to a merchant. Only card-absent transactions are considered for VAMP.

A monthly minimum of 1,000 fraud and non-fraud related disputes apply to merchant thresholds. Merchants with fewer than 1,000 applicable fraudulent or disputed transactions are excluded.

The calculation consists of these terms:

- Fraud transactions (TC40) — Transactions marked as fraud by the issuing bank and reported to Visa.

- Non-fraud disputes — Visa chargebacks with all reason codes except 10.XX.

VAMP Excludes Rapid Dispute Resolution (RDR) Disputes and Cardholder Dispute Resolution Network (CDRN) Alerts - Total sales count — All transactions where the card is not physically present, such as online purchases that were processed through Visa.

The first 6 months of VAMP is considered an “Advisory Period” where no fees will be assessed. Starting in October 2025, the below fee structure will be valid:

VAMP Ratios

If a merchant exceeds the following thresholds, there is a three month grace period for the merchant to make changes to reduce the thresholds:

| Date | Threshold |

|---|---|

| As of April 1, 2025 | > = 1.5% is considered excessive |

| As of January 1, 2026 | > = 0.9% is considered excessive |

Beginning in the fourth month, there is a $10 fee assessed to each dispute (both fraud and non-fraud). Those fees are subject to change, per Visa.

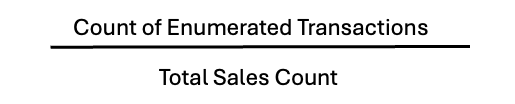

In addition to the transaction counts, a new enumeration ratio has been created to monitor card testing. Merchants with fewer than 300,000 enumerated transactions will be excluded.

VAMP Enumeration Ratio Calculation

Visa uses the following equation to calculate the VAMP enumeration ratio. As of April 1, 2025 >= 20% is considered excessive.

Release from Card Brand Programs

Merchants are released from excessive chargeback and fraud monitoring programs when they haven't met or exceeded program thresholds for three consecutive months.

Updated 4 months ago