3-D Secure

3-D Secure (3DS) and 3-D Secure 2 (3DS2) are solutions that improve online payment security.

3-D Secure is an advanced authentication solution implemented to reduce eCommerce fraud by verifying a cardholder’s identity in real time. This additional layer of security helps prevent unauthorized use of cards and protects eCommerce merchants and issuers from exposure to fraud. Each of the major card brands has a 3-D Secure offering:

- American Express Safekey®

- Discover ProtectBuy® (covers Discover and Diners Club International®)

- Mastercard SecureCode®

- Visa Secure®

3-D Secure 2 is the new global specification for card payment security developed by EMVCo. It is designed to deliver frictionless payment authentication across a range of devices, including mobile devices. Unlike previous versions of 3DS, it allows for more seamless integration with merchants’ e-commerce customer experiences. 3DS2 is being deployed across Europe. For details on the implementation date click here.

Using 3DS2 satisfies the PSD2 requirement for SCA. For additional details, review the following links:

- For more details about the 3DS2 specification, visit the EMVCo site.

- For answers to questions related to BlueSnap and 3DS2, PSD2, and SCA, refer to our 3‑D Secure 2 FAQs page.

- For specific use cases regarding how 3DS2, PSD2, and SCA are implemented at BlueSnap, refer to the Use Cases.

Terminology

- 3-D Secure (3DS): an advanced authentication solution

- 3-D Secure 2 (3DS2): the new global specification for 3DS

- CIT: Customer-Initiated Transaction

- MIT: Merchant-Initiated Transaction

- MOTO: Mail Order and Telephone Order transaction

- PSD2: Revised Payment Services Directive

(For more information, refer to our 3-D Secure 2 FAQs page.) - SCA: Strong Customer Authentication

(For more information, refer to our 3-D Secure 2 FAQs page.) - TRA: Transaction Risk Analysis

Out-of-Scope Transactions

The intent of PSD2 is to make SCA a requirement for all online transactions. However, there are some transactions that are considered out of scope.

Anonymous Transactions

Transactions through anonymous payment instruments are not subject to the SCA mandate, for example anonymous prepaid cards.

Inter-regional Transactions

Inter‑regional Transactions are usually exempt. An Inter‑regional Transaction is one in which the issuer or the acquirer of the card is not based in the EEA (European Economic Area) or the UK. For example, accepting payments in Europe from non‑European shoppers is not in the scope of PSD2.

Merchant-Initiated Transaction (MIT)

Most subscription or recurring transactions with a fixed amount (same amount each time) are exempt after the initial transaction; only the initial transaction requires SCA.

Some subscriptions have a variable charge based on usage. These types of transactions are usually considered merchant‑initiated transactions. These are exempt from PSD2 and SCA requirements.

Payments made with a card on file when the customer is not present in the checkout flow may qualify as merchant‑initiated transactions. These payments fall outside the scope of SCA; however, ultimately the issuing bank must decide if SCA is needed for the transaction.

BlueSnap works with merchants to apply this out-of-scope exemption for applicable transactions.

API

In the API, MIT transactions are indicated using:

"transactionInitiator":"MERCHANT". For more information, refer to these examples.

Mail Order and Telephone Orders (MOTO) Transaction

MOTO transactions are exempt from SCA in all cases. The MOTO transactions are not considered to be "electronic" payments, so are out of the scope of the regulation.

BlueSnap works with merchants to apply this out-of-scope exemption for applicable transactions.

API

In the API, MOTO transactions are indicated using

"transactionOrderSource":"MOTO". For more information, refer here.

SCA Exemptions

Transactions in this section are exempt from SCA requirements.

Low Value Transactions

Transactions under 30 EUR are exempt from SCA. The issuing bank must track the amount of each payment made. If the total amount attempted on a single card without SCA is greater than 100 EUR, or for every 5 transactions on a single card, SCA is required.

BlueSnap automatically applies this exemption for applicable transactions.

Transaction Risk Analysis (TRA)

The TRA exemption allows for certain remote transactions to be exempted from SCA provided a robust risk analysis is performed.

BlueSnap automatically applies this exemption for applicable transactions.

Trusted Beneficiaries

Customers can assign merchants to a list of Trusted Beneficiaries that is maintained by their bank. These trusted merchants are exempt from PSD2 for SCA. This allows customers who regularly shop with a business to shop without providing SCA after the business is added to the list.

Payee-Initiated

Payee-initiated transactions are exempt. A payee‑initiated transaction occurs when the payer’s consent for a direct debit transaction is given in the form of an electronic mandate with the involvement of its PSP. For example, SEPA is a payee‑initiated transaction.

Secure Corporate Payments

Payments made through dedicated corporate processes and protocols (for example, lodge cards, central travel accounts, and virtual cards) that are initiated by business entities, are not available to consumers, and that already offer high levels of protection from fraud may be exempt from SCA.

Chargeback Liability Shift

In addition to preventing unauthorized card use, 3DS can shift liability for fraud chargebacks from the merchant to the card issuer in these situations:

- Situation 1: Shopper successfully verifies their identity, passing SCA authentication.

- Situation 2: An issuer who perceives the transaction to be low risk authenticates without requiring SCA from the shopper.

- In Situation 2, the shopper never gets a pop-up window requesting SCA during checkout, making the 3DS-flow entirely transparent to them.

Note: In order for a liability shift to occur, the region where the authentication takes place must support 3DS liability shifts. The following table outlines this support.

| Region | Support date |

|---|---|

| Canada, Latin America, and the Caribbean | August 15, 2019 |

| Asia Pacific, Central Europe, Middle East, and Africa | April 15, 2020 |

| Rest of Europe | March 1, 2020 |

| United States | August 15, 2020 |

Fraud Liability Summary

| Transaction Type | SCA Required? | Issuer Challenged | Fraud Liability |

|---|---|---|---|

| CIT | Yes | Yes | Issuer |

| CIT | Yes | No | Issuer |

| CIT | No; Low Value Exemption | No | Issuer |

| CIT | No; Transaction Risk Analysis (TRA) Exemption | No | Merchant |

| CIT | No; Secure Corporate Payment Exemption | No | Issuer |

| CIT | No; White Listing Exemption | No | Issuer |

| CIT | No; Inter-regional Exemption | No | Merchant |

| MOTO | No | No | Merchant |

| MIT | No | No | Merchant |

Chargebacks may still occur

You may still receive fraud chargebacks for transactions authenticated using 3DS. However, these chargebacks are considered invalid. If you receive a chargeback on an authenticated 3DS transaction you should dispute the chargeback through BlueSnap’s chargeback management services.

Rules for MITs

-

Merchants must store the Network Transaction ID of the CIT that established the agreement, for future MITs.

-

A MIT can only occur after an initial CIT has been performed to establish a customer agreement.

-

MITs must be properly indicated as MITs to ensure they are treated as out of scope of SCA.

-

Merchants should only request MIT authorization when the goods are available and ready to be shipped.

-

"Grandfathering" can be applied to a MIT if the transaction is performed based on an agreement made prior to the implementation of PSD2. Refer to the Use Cases for details.

-

When setting up an agreement to process future MITs, the merchant can only authenticate and authorize for the amount needed on the day the agreement is signed. Authorizing any additional amount unnecessarily only impacts the cardholder’s "open to buy" limit.

Use Cases

MIT and MOTO are out-of-scope transactions. When properly flagged, these transactions should not require SCA by issuers.

Create a new subscription and submit on-going subscription payments as MITs

You must perform the following 3 steps to establish a customer/merchant agreement and to submit the initial and recurring subscription charges.

-

The merchant authenticates the shopper for the amount due immediately.

-

After the cardholder is successfully authenticated, merchant authorizes for the amount due that day. If no amount is due that day, the merchant should perform a zero‑amount authorization. The merchant obtains and stores the initial transaction ID, known as the Network Transaction ID, for future MITs.

-

When the next payment is due, the merchant initiates the payment as a MIT by sending the auth‑capture request with the Network Transaction ID and flagging it as a MIT. (In the API, this is done using:

"transactionInitiator":"MERCHANT". For more information, refer to these examples.)

Cardholder calls to establish stored credentials for future MITs

Sometimes a cardholder establishes an agreement with a merchant over the phone, by mail, or email. In those cases, the initial transaction is MOTO transaction. All subsequent transactions made under that agreement should not be flagged as MOTO; they are MITs unless they too are made by phone, by mail, or email. The detailed steps are:

-

The cardholder provides the card information by phone, email, or mail order.

-

The merchant sends MOTO transaction authorization with the amount (or zero‑amount); no SCA is required. (In the API, this is done using

"transactionOrderSource:MOTO". For more information, refer here.) -

The merchant obtains and stores the Network Transaction ID from step 2 for future MITs.

-

The merchant initiates a MIT for subsequent payments, the merchant sends the MIT flag and the Network Transaction ID in the authorization request to issuer. (The Network Transaction ID links the MIT to the initial MOTO transaction.)

Cardholder calls to establish stored credentials for future MOTO and CIT

-

The cardholder provides the stored credentials by MOTO and the merchant saves the card on file. No SCA is required for the MOTO transaction.

-

The cardholder comes back again to make a purchase using the stored credentials; the transaction must be flagged correctly based on the channel:

-

If the cardholder makes a purchase by phone, mail, or email, the transaction should be flagged as MOTO and no SCA is required. The merchant directly sends the transaction as a MOTO authorization request. (In the API, MOTO transactions are indicated using

"transactionOrderSource:MOTO". For more information, refer here.) -

If the cardholder makes a purchase through the merchant's website, the transaction should be flagged as an ecommerce transaction and requires SCA.

Note: The SCA requirement for a transaction with stored credentials is determined by how the transaction is processed not by how the stored credentials were initially established.

-

MITs and MOTO transactions are out of scope for PSD2.

-

CITs usually require SCA.

-

Network Transaction ID in subscription and MITs and how to use Grandfathering to process MITs with agreements made before PSD2.

The Network Transaction ID is a data field returned either during account verification or the initial CIT related to subsequent MITs. When included in future MIT authorization requests, the Network Transaction ID lets the issuer know that the MIT is a subsequent payment for a subscription and is related to the initial CIT.

A merchant using their own subscription management engine must store the Network Transaction ID on their end for Visa and MasterCard transactions. The Network Transaction ID should be included in all future MITs for Mastercard and Visa transactions. American Express transactions do not require the Network Transaction ID; merchants can flag the subsequent MITs as a recurring transaction.

The merchant and cardholder have an existing agreement established prior to the implementation of PSD2. The merchant does not need to re-establish a new agreement with their customer.

-

For merchants not using BlueSnap's subscription functionality:

- If you do not have a Network Transaction ID (NTI), pass the parameter "transactionInitiator":"MERCHANT" in the API request.

- If you receive a Network Transaction ID (NTI) from us, save the NTI and pass it to us for all subsequent MIT transactions.

-

For American Express, the merchant must flag the transaction as MIT.

(To flag a transaction as MIT in the API, use "transactionInitiator":"MERCHANT". For more information, refer to these examples.)

Renew subscription

-

If the new subscription uses the same stored card and the same address, the merchant can use the old Network Transaction ID and continue flagging subsequent transactions as MIT.

-

If the new subscription uses a new card or a new address, the merchant must put the cardholder through SCA.

Submit an order with MOTO or merchant-managed virtual terminal

This is a MOTO transaction and needs to be flagged as a MOTO transaction; no SCA is required. For subsequent transactions, the merchant flags the order as MIT with the Network Transaction ID obtained from the original MOTO transaction.

In the API

MOTO transactions are indicated using

"transactionOrderSource:MOTO". For more information, refer here.MIT transactions are indicated using:

"transactionInitiator":"MERCHANT". For more information, refer to these examples.

Customer agreement changes

Sometimes, a merchant or customer may need to change the payment terms of the ongoing agreement. SCA is always recommended in those situations; however, the merchant may opt not to authenticate if certain conditions apply:

-

For merchant-driven changes to payment terms, SCA is not required provided that the original agreement terms and

conditions and other cardholder communications clearly covered the eventuality of such changes. -

For customer-driven changes, if the customer requests a change to pricing and terms, pauses an agreement, or stops and restarts an agreement, SCA is not required provided that the agreement terms and conditions clearly covered the eventuality of such changes and the merchant has the necessary risk management in place.

Cardholder changes delivery address

If a cardholder goes into their merchant account and updates the delivery address for an order, SCA is not required by regulation. However, it is recommended that SCA be performed if the customer changes the delivery address linked to an in-process order as this represents a risk of fraud.

Payment credentials updated by account updater

The merchant received updated payment credentials from the Issuer. SCA is not required; however, under Visa rules, this must be addressed through terms and conditions and other cardholder communications.

Create a vaulted shopper then create recurring transactions for that shopper

-

The cardholder provides the credentials to be stored and the merchant authenticates the shopper. This is true whether the initial transaction is for $0 to simply vault the shopper or for a purchase. SCA is required for this CIT transaction.

-

The cardholder comes back again to make a purchase using the stored credentials; the transaction must be flagged correctly based on the channel:

-

If the cardholder makes a purchase by phone, mail, or email, the transaction should be flagged as MOTO and no SCA is required. The merchant directly sends the transaction as a MOTO authorization request. (In the API, MOTO transactions are indicated using

"transactionOrderSource:MOTO". For more information, refer here.) -

If the cardholder makes a purchase through the merchant's website, the transaction should be flagged as an e-commerce transaction and requires SCA.

Note: The SCA requirement for a transaction with stored credentials is determined by how the transaction is processed not by how the stored credentials were initially established.

-

MITs and MOTO transactions are out of scope for PSD2.

-

CITs usually require SCA.

-

Migrating Subscriptions Regarding 3DS

If you are moving to BlueSnap from another processor and migrating your subscriptions, your cardholders do not need to undergo 3DS authentication again. You can continue the subscription with BlueSnap by sending an Auth Capture request with the following request properties:

- Send the network transaction ID in networkTransactionInfo.

- Send

MERCHANTintransactionInitiator.

For more information, refer to these request examples .

Enable and Configure 3-D Secure

To get started, contact Merchant Support to request that BlueSnap enable 3DS for your account. After it has been enabled, you can activate and configure it in 3-D Secure settings below.

3-D Secure Settings

In your Merchant Portal to the 3-D Secure Rules section under Settings > Fraud Settings.

Enable 3-D Secure

After 3-D Secure (3DS) has been enabled for your account, activate it by selecting this option.

Important

Enabling 3DS on your account initiates an authentication request to the issuer for every customers regardless of where they are located. The issuing bank must decide if SCA is needed for the transaction.

- If the issuer requires authentication, then the shopper is presented with an SCA challenge.

- If issuer does not require authentication, then the shopper experiences the same flow as if 3-D Secure is not enabled.

Send 3DS authenticated transactions to Kount

If this option is enabled, all transactions that are successfully authenticated with 3DS will also go through BlueSnap's fraud checks through Kount.

Process failed 3DS transactions

If this feature is enabled, transactions that fail 3DS authentication will still be processed. This option is not available for Europe and the UK.

Use Caution when enabling this option

Exclude countries for 3DS

This lets you include and exclude specific countries from 3DS verification. Select countries from either list and click the arrow to move them to the other list. You can select a single country, multiple countries, or all countries.

When a country is in the Exclude list, transactions from that country do not go through the 3DS authentication process. Keep in mind that you cannot exclude countries in Europe and the UK.

Please note that the issuing country of the authentication (determined by the BIN Number of the credit card being used at the checkout) takes priority over the billing country provided in the request.

3-D Secure Integrations

BlueSnap Checkout and Hosted Pages

BlueSnap Checkout and our Hosted Pages provide out-of-the-box support for 3DS. Simply ensure that 3DS is enabled.

Payment API

BlueSnap's Payment API provides built-in support for 3DS. Complete implementation details are available in this 3-D Secure API Guide.

Shopper Experience

The following steps outline the general 3DS flow with images taken from a BlueSnap Hosted Page.

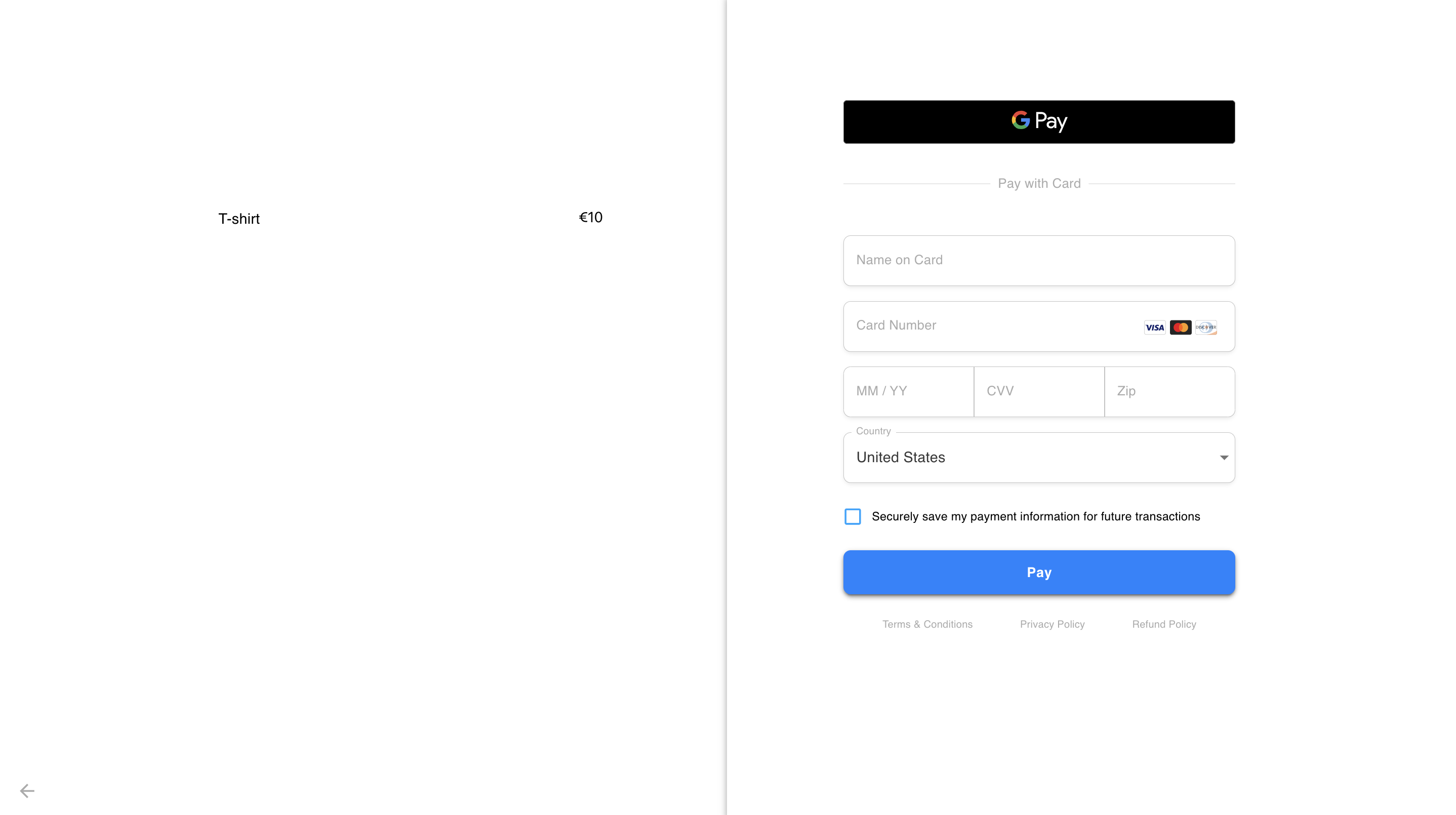

Step 1: Shopper enters card information and submits payment form

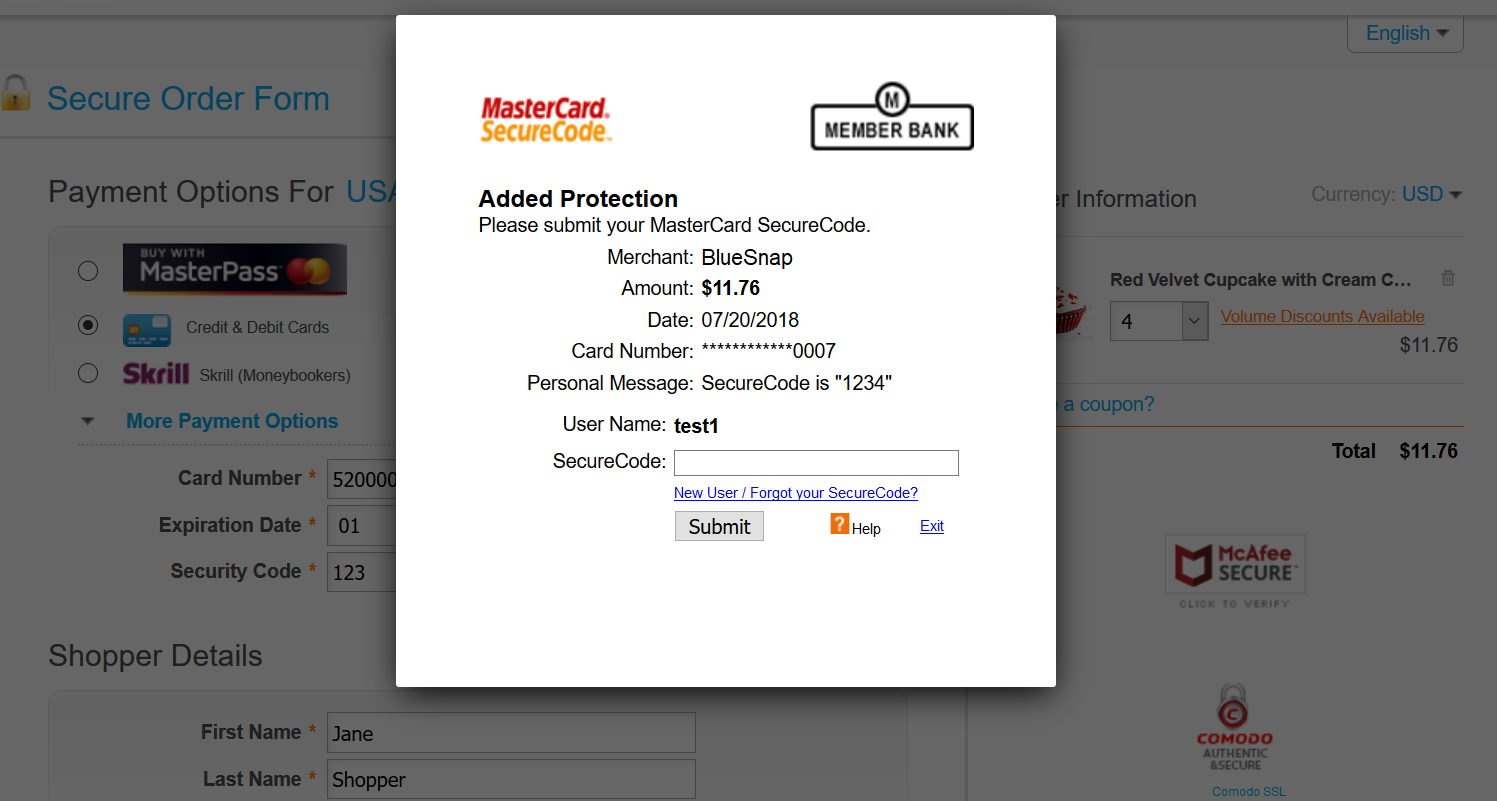

Step 2: If shopper verification is required, a popup prompts the shopper to enter a password

A lookup is performed during checkout to determine if the issuer requires identity verification from the shopper. If required, a popup like the one below prompts the shopper to enter a password, which is typically a one-time code sent by text message.

Step 3: Confirmation

A confirmation page for your order is displayed.

Virtual Terminal

-

If you are using BlueSnap's Virtual Terminal, you don’t need to do any coding. BlueSnap processes these transactions as MOTO and identifies the out‑of‑scope transactions for you, and therefore do not need to do any coding.

-

If you are using your own self‑developed virtual terminal, when you submit the transactions to BlueSnap, these transactions need to be flagged as MOTO, so we can submit the authorization request as MOTO to processors, and the transactions do not require SCA.

Subscriptions

-

If you are using the BlueSnap Subscription Engine or our merchant-managed subscription feature, BlueSnap manages all subscription transactions. You do not need to do any coding, BlueSnap handles the exemptions and the out‑of‑scope transactions for you.

-

If you handle your own subscriptions (meaning you are sending straight auth‑capture requests not using the BlueSnap Subscription Engine or our merchant-managed subscription feature), follow the information in the Use Cases for details on how to continue your existing subscriptions.

Test 3-D Secure 2

You can test 3-D Secure 2 (3DS2) using our test page. Use any of the card numbers below to test various 3DS2 results.

Test Cards

The following cards are only valid on a system with 3DS2 enabled. The test system (accessed through the button above) does have 3DS2 enabled.

- If you want to use these cards on your system, you need to have 3DS2 enabled. To have 3DS2 enabled on your system, contact an Implementation Specialist.

- The test cards listed in the table below use EMV 3DS Version 2.2.0.

| Authentication Result | Card numbers |

|---|---|

| Successful with challenge (step up) | Visa: 4000000000002503 Mastercard: 5200000000002151 American Express: 340000000002534 Discover (Diners Club): 6011000000002265 |

| Successful without challenge (frictionless) | Visa: 4000000000002701 Mastercard: 5200000000002235 American Express: 340000000002708 Discover (Diners Club): 6011000000002117 |

| Failed with challenge (step up) | Visa: 4000000000002370 Mastercard: 5200000000002490 American Express: 340000000002237 Discover (Diners Club): 6011000000002695 |

| Failed without challenge (frictionless) | Visa: 4000000000002925 Mastercard: 5200000000002276 American Express: 340000000002096 Discover (Diners Club): 6011000000002364 |

| Unavailable | Visa: 4000000000002990 Mastercard: 5200000000002409 American Express: 340000000002468 Discover (Diners Club): 6011000000002836 |

Card Data

- Expiration Date

- The expiration month is always January.

- The expiration year is the current year plus 3 years.

For example: In 2024, the Expiration Date value is 01/2027.- Security Code (CVV): any 3‑digit code

- Challenge: If challenged

- The user name (test1) is prefilled.

- The password is

1234

Updated 2 months ago