AVS and CVV Rules

How to use the Address Verification Service (AVS) and Card Verification Value (CVV) fraud tools

When you submit a transaction request for a credit or debit card, BlueSnap passes the address and CVV information as entered by the cardholder to the issuing bank. The bank’s response usually includes AVS and CVV response codes. These codes indicate whether the numeric values in the address and CVV match their records for that cardholder.

Many banks approve transactions even if the address information or CVV included with the order does not match what they have on file for that cardholder. Banks approve these transactions because they often have the right to chargeback the purchase to the merchant if the transaction is later determined to be fraudulent; and this costs you money.

AVS rules are particularly useful for merchants that ship physical merchandise. If the issuing bank’s response triggers one of your AVS or CVV rules, we send a void request to the issuing bank. Alternatively, if you choose not to enable AVS or CVV rules, BlueSnap will not take any action based on the response codes.

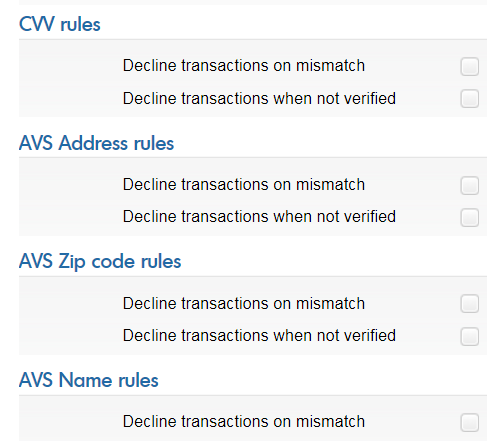

Enabling AVS and CVV rules

Rule Details

Note what each rule verifies:

- CVV rules: CVV

- AVS Address rules: street number

- AVS Zip code rules: postal code

- AVS Name rules: street name (i.e. Main St. vs Mian St.)

-

In the Merchant Portal, go to Settings > Fraud Settings.

-

Select the checkboxes to define when you want transactions to be declined based on the AVS or CVV verifications.

-

Decline transactions on mismatch: The transaction is declined if the CVV or AVS information provided by the shopper does not match the issuing bank's records.

-

Decline transactions when not verified: The transaction is declined if the CVV or AVS information could not be verified by the issuing bank. This could be due to a temporary error in the verification process.

-

-

Click Submit.

Be aware

Enabling the following rules may result in false declines.

CVV rules — Decline transactions when not verified

The issuer may not verify a CVV that was entered correctly, resulting in a false decline.AVS Address rules — Decline transactions on mismatch

The entered address may be slightly different from the issuer's records, resulting in a false decline. For example, a decline may result if the shopper enters "1 North Street" when their address is "1 North St." in the issuer's records.

Applicability to US and International Transactions

AVS and CVV rules apply to all United States credit card and debit card transactions.

Issuing banks in most countries other than the United States do not consistently support AVS. Therefore, declines due to AVS mismatch are applied to international transactions only if BlueSnap receives this response from the issuing bank. The rule to decline transactions when AVS information is not verified apply only to US transactions.

Updated 23 days ago