Standard Reporting

With BlueSnap's out-of-the-box reporting and analytics capabilities, you can dive into the critical eCommerce data that drives your business, and get insights to help you boost conversions.

Custom Reporting

Want more control over your reporting and analytics? BlueSnap's Custom Reporting feature allows you to create, manage, and run your own reports based on your transaction or payout data.

Accessing Reports

Online

We provide online reporting capabilities, with the option to download reports, right in the Merchant Portal. To access all reports, go to Account Activity > Reports in the Merchant Portal. In addition, an overview of your account's sales and conversions is available at Account Activity > Dashboard (refer to Dashboard).

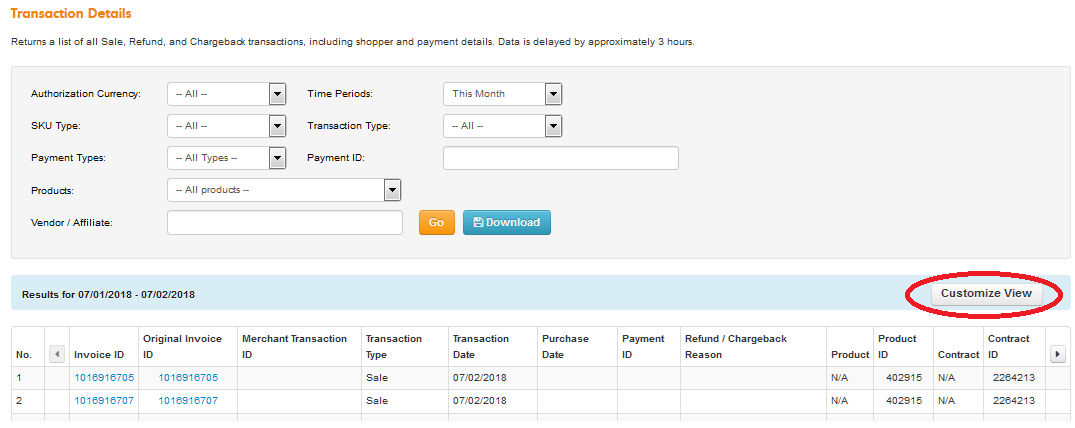

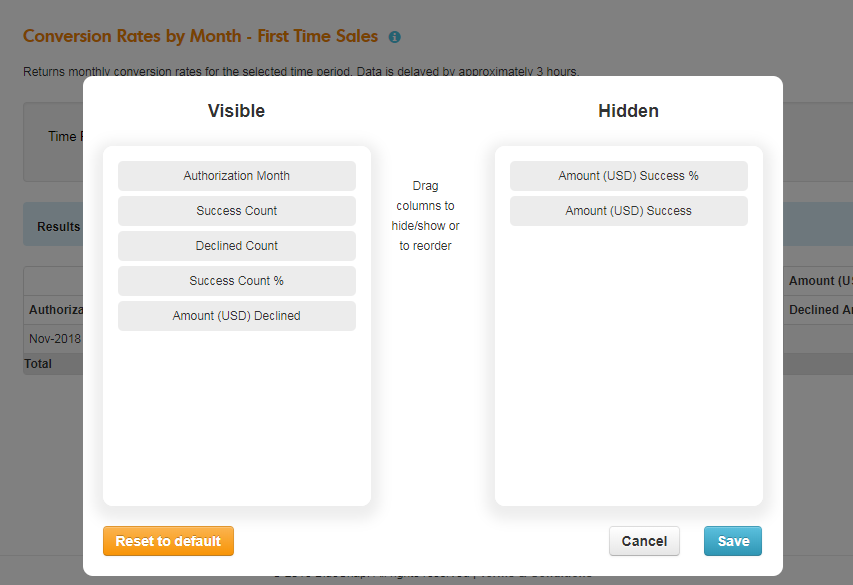

Once you run your report, you can customize it by selecting columns you don't want to include. To manage your report data, click Customize View; in the results header. For example:

A dialog box displays where you can drag the report columns you want to hide into the Hidden column. Once you have decided on the fields you want to include on your report, you can move the fields up and down the Visible list to reorder the report columns to your exact view.

To reset the column order to its default setting (i.e., all columns revert to the Visible setting), click Reset to default.

Click Save to complete the process, and view your customized report.

Note:

When you download the report and then view it, your hidden fields are available to you, so you can manage your report information.

Reporting API

Pull any payment data right from the Reporting API, parse it according to your needs, or push it to your third-party reporting tools. This API provides the ultimate reporting flexibility and accessibility. Learn more about the Reporting API.

Available Reports

This section provides an overview of the reports available to you through the Merchant Portal and the Reporting API (refer to Accessing reports). More information on any of these reports can be found in the left menu: Click a specific report to view a detailed description and a list of all its column names and descriptions.

Notes

- Data availability

- Real-time transaction data is available in the Recent Transactions report.

- All other reports have a time delay. Refer to the specific report in the left-side menu to learn more.

- Data formats: All reports show currency values in US format (i.e., 123,456.00) regardless of the currency being displayed.

Transactions Reports

Accurately track the life-cycle of your customer base with the following reports about your sales and revenue.

-

ACH/Direct Debit

Track your ACH/Electronic Check and SEPA Direct Debit transactions and their associated invoice statuses.

Learn more. -

Declined Transactions

Obtain details about each card transaction declined by the issuing bank, including the date, decline reason, transaction amount, and shopper info. This information is helpful when you need to reach out to shoppers with declined payments.

Learn more. -

Pending Refunds

View a list of all refunds pending processing due to insufficient balance funds.

Learn more. -

Recent Transactions

Stay informed of all transactions that occurred in the last 4 hours with details such as sale amount, payment type, and shopper info. Data is posted in real-time.

Learn more. -

Status of Attempts to Add Card

Stay informed of all card addition and update attempts. Data is posted in real-time.

Learn more. -

Transaction Details

Obtain detailed information, such as shopper and payment info, about your sale, refund, and chargeback transactions.

Learn more. -

Transaction Summary

Track sale, refund, and chargeback transactions by product and authorization currency to understand how certain transaction types relate to your product catalog.

Learn more.

Conversions reports

Payment Conversions reports provide an in-depth analysis of your authorization results. Any report view can be run for one-time or recurring charges. Learn more.

Payout Reports

The following reports can help simplify your payout reconciliation process whether it’s performed daily, weekly, monthly, or some other interval.

-

Account Balance

Obtain details about your current account balance (the funds that have not been paid out yet) in each of your payout currencies.

Learn more. -

Account Balance Detail

Obtain details about your current account balance (the funds that have not been paid out yet) in each of your payout currencies, so you can view all of the transactions that were included in the balance calculation.

Learn more. -

Declined Auth Details

Obtain details about all authorizations that were declined, such as the card type, shopper name, and any fees for those that have been charged. This report is helpful for reconciling any fees for declined authorizations.

Learn more. -

Payout Details

Retrieving transaction-level payout details is helpful when reconciling the processing fees charged by BlueSnap with the transactions you processed.

Learn more. -

Payout Summary Statement

Access summary reports from past payout cycles to view details such as sales, refunds, fees, and more.

Learn more. -

Running Balance

Review your balance in real-time, as well as affecting events.

Learn more. -

Summary of Processing Statements

Summarizes all of your individual Payout Summary Statements. This report has all the information you need to reconcile your gross sales with the amount deposited into your bank account for each payout currency.

Learn more.

Subscriptions Reports

Use these reports to track your active and canceled subscriptions, as well as Account Updater results.

-

Account Updater (BlueSnap Vault Cards)

If you are using BlueSnap's vault to store card data, you can use this report to obtain details about updated cards, such as the update date and results.

Learn more. -

Account Updater (Merchant Vault Cards)

If you are vaulting your own credit card numbers, you can use this report to obtain details about your Account Updater requests, such as the update status and response codes.

Learn more. -

Active Subscriptions

Obtain details for all active subscriptions, including shopper email and name, and the next subscription charge date.

Learn more. -

Canceled Subscriptions

Obtain details for all canceled subscriptions, including price, shopper, and cancellation details.

Learn more. -

Recurring Charges

Obtain details about all the recurring charges that were attempted.

Learn more.

Cleanse Reports

BlueSnap has partnered with Kount to identify and eliminate fraudulent activity through customer data and purchase behavior analysis. Obtain details about these insights through Cleanse reports.

Learn more.

Other Reports

-

Affiliate Sales Summary

Stay up-to-date on affiliates with this report containing details on total sales, commission, and more.

Learn more. -

IPN Locator

Provides information about BlueSnap IPNs.

Learn more. -

Sales by Product & Currency

Track sales by product and authorization currency to understand how purchase behavior relates to your product catalog.

Learn more. -

Stopped Fraud by Reason

Access the number of stopped fraud transactions for each fraud reason code.

Learn more. -

Stopped Fraud

Obtain details about transactions that were declined because of your fraud rules or BlueSnap's fraud detection logic.

Learn more. -

Vendor Details

If you are a Marketplace, you can use this report to obtain details about your vendors, including their account, processing, and payout statuses.

Learn more.

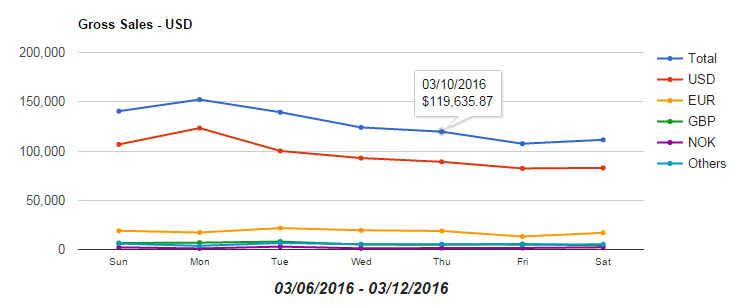

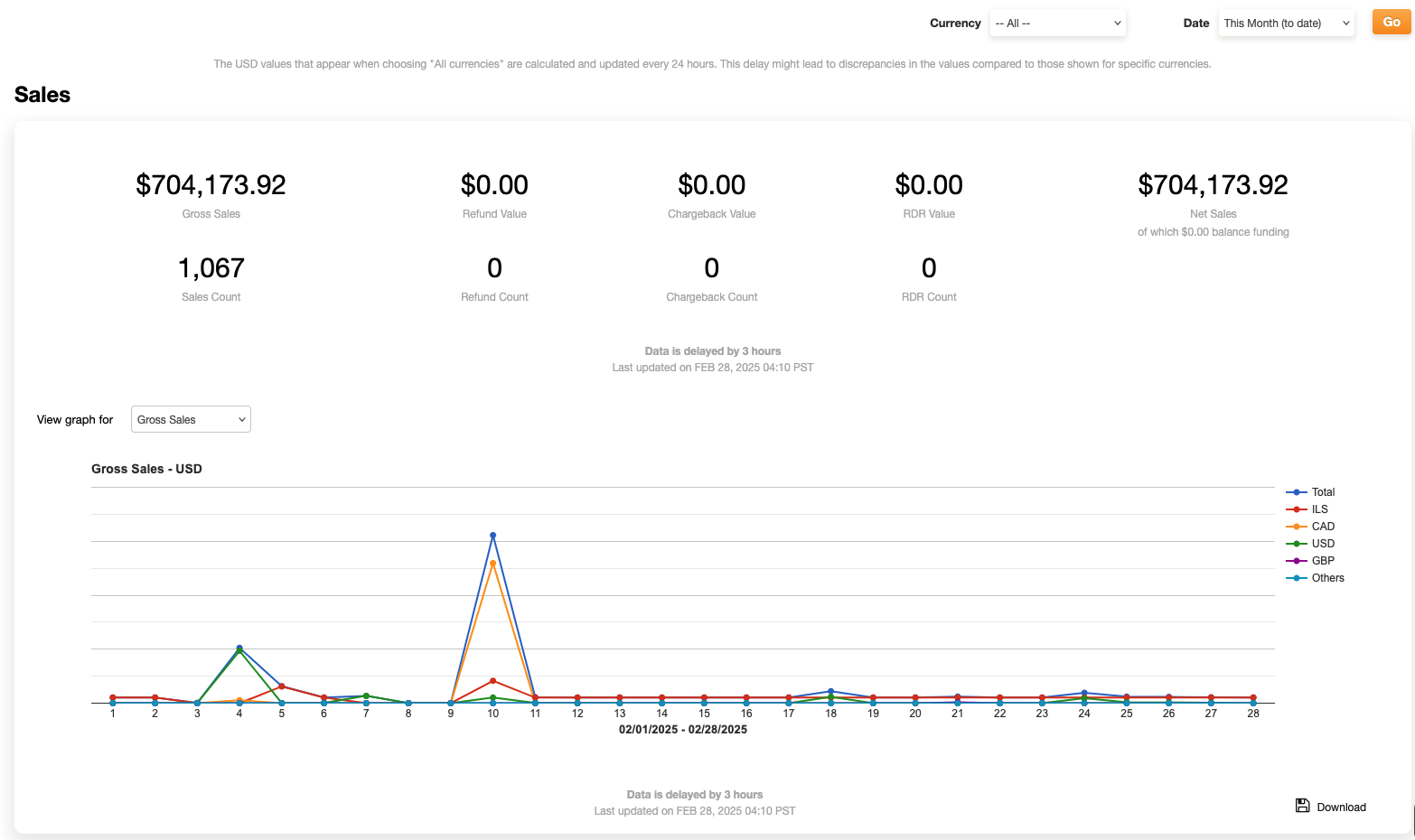

Dashboard

In your Merchant Portal, the view under Account Activity > Dashboard provides a summary of key statistics about your account's sales and conversions. You can change the view to show specific currencies or time periods in order to focus on a certain segment of transactions.

Selected Currency

When a user selects the All currencies option and has more than 1 currency in the selected period, the amount will be displayed in USD.

When a user selects a specific currency or the user only has one base currency (different than USD), the amount will be displayed in currency units.

Account Balance & Last Payment

This section provides an overview of your current account balance for each payout currency, as well as the details of your last payout.

Note

Since the reports in the dashboard have independent generation delays, each dashboard report has a "Last updated on" entry. For example, the Account Balance report shown below was last updated on: Nov 4, 2018 at 16:08 PST.

Sales

This section summarizes total value and event count, and lets you filter the graph for the following metrics:

- Gross Sales

- Refunds

- Chargebacks

- Net Sales

- Sales Count

You can also view a graph for each of these metrics. If you select All currencies, the chart will display a line for each of your top four currencies, plus one line for all other currencies together, and another line for the total. The totals are displayed in USD.

Sales Count

Sales Count includes card verification requests ($0.00 Auth).

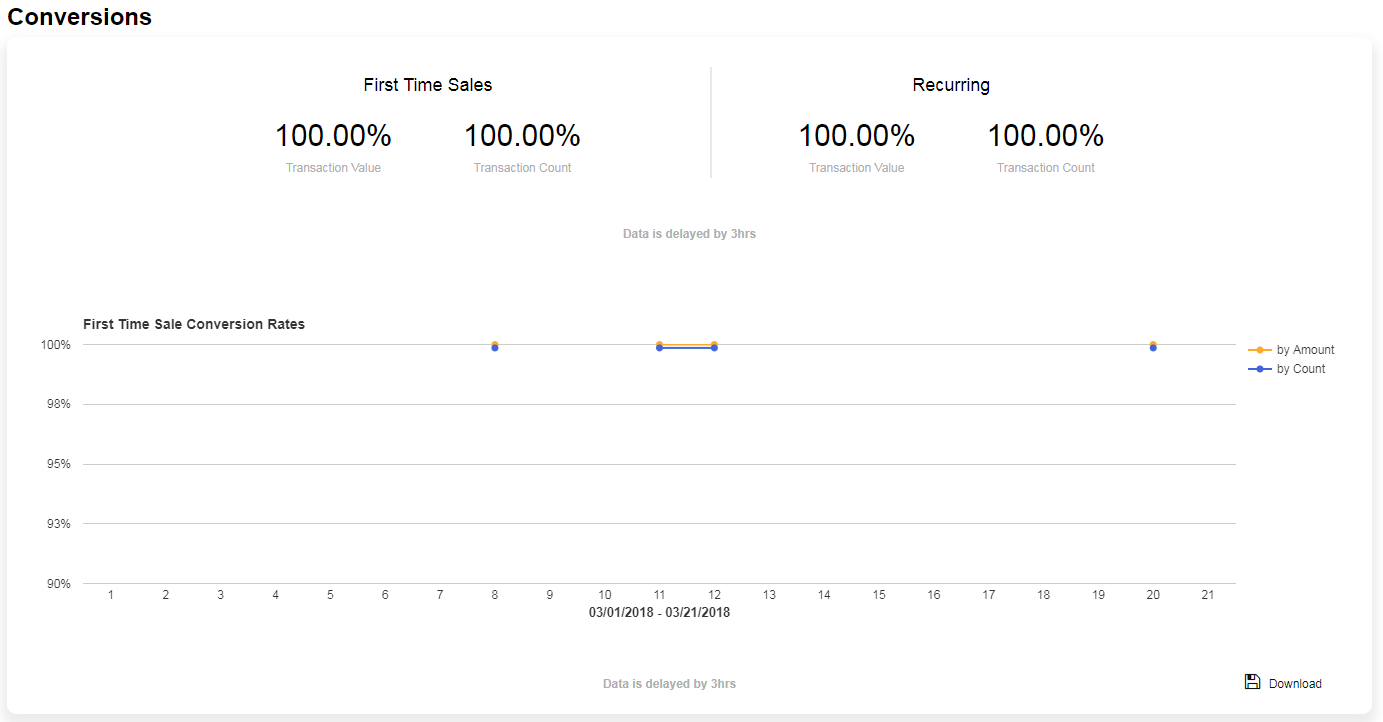

Conversions

This section provides in-depth analysis into your processing rates by looking at first time or recurring sales and conversion rates. You can then make any necessary adjustments in order to improve conversion success.

Data availability

There is currently a time delay of 2-3 hours for report data, therefore, it does not include data for transactions that took place within the last 3 hours.

Exporting Reports

You can export reports to CSV by clicking the Download icon on the report page in your Merchant Portal.

Displaying special characters

Due to an Excel limitation, special characters in CSV fields sometimes are not displayed properly in Excel. To display these characters, follow these steps on a Windows computer:

- In Excel, click File > New.

- Click the Data tab, select the From Text option, and select the CSV you file you downloaded from BlueSnap.

- In the Text Import Wizard, select Delimited, choose the 65001 : Unicode (UTF-8) file origin and select Comma.

- Click Finish and OK, and your data will then be correctly displayed.

For Macs

If you are using a Mac, use the Numbers application instead of Excel, and the characters will display properly.

Updated 2 months ago