Surcharges

Learn about AR Automation's surcharge functionality

A surcharge fee is added by a merchant as an additional fee to a transaction when a customer uses a bank card or other payment method than cash for a transaction. A surcharge fee is applied where permitted to cover the costs of accepting credit cards, and in limited countries, debit cards. Merchants who choose to surcharge must follow consumer disclosure and other requirements, which include card brand rules, and country and state laws.

Surcharging adds a cost for your transaction and for the shopper. It may harm your shopper experience. In addition, compliance with applicable laws, rules, and regulations addressing surcharges is critical. Some states and countries prohibit surcharging and state laws in the United States are subject to change. Prohibitions, restrictions, or limitations may be added. The following information offers guidance for your consideration but is subject to change. As a merchant, you must ensure compliance. If you have any questions, please consult your legal counsel.

Implementation Rules

BlueSnap offers a surcharging solution in Australia, Canada, and the United States. Before you enable surcharging on your account, please keep the following considerations in mind.

Payment Methods

Bank Cards

Card brand rules and country laws dictate whether surcharges on credit, debit or prepaid cards are allowed.

| Billing Country | Surcharging | Notes |

|---|---|---|

| Australia | Can be applied to credit, debit, and prepaid cards | |

| Canada | Can be applied to credit cards only | Not applicable to debit/prepaid cards |

| US | Can be applied to credit cards only | Not applicable to debit/prepaid cards |

Card Brands

The card brands that allow surcharging with limits as applicable are Amex, Discover, MasterCard, and Visa.

Electronic Fund Transfers (EFT)

BlueSnap functionality allows surcharges to be applied to transactions processed through ACH payments for customers located in the United States, and for BECS and PAD in Australia and Canada respectively. The surcharge percentage rate can be set separately for card and EFT payments.

Territory Requirements for Surcharging

Shopper Location Prohibitions in the US

Certain US states and territories prohibit surcharging. BlueSnap prohibits surcharging for shoppers residing in these locations.

States and territories that prohibit surcharging:

- CT Connecticut

- ME Maine

- MA Massachusetts

- OK Oklahoma

- PR Puerto Rico

States that allow surcharging:

- AL Alabama

- AK Alaska

- AZ Arizona

- AR Arkansas

- CA California

- CO Colorado*

- DE Delaware

- FL Florida

- GA Georgia

- HI Hawaii

- ID Idaho

- IL Illinois

- IN Indiana

- IA Iowa

- KS Kansas

- KY Kentucky

- LA Louisiana

- MD Maryland

- MI Michigan

- MN Minnesota

- MS Mississippi

- MO Missouri

- MT Montana

- NE Nebraska

- NV Nevada

- NH New Hampshire

- NJ New Jersey**

- NM New Mexico

- NY New York

- NC North Carolina

- ND North Dakota

- OH Ohio

- OR Oregon

- PA Pennsylvania

- RI Rhode Island

- SC South Carolina

- SD South Dakota

- TN Tennessee

- TX Texas

- UT Utah

- VT Vermont

- VA Virginia

- WA Washington

- WV West Virginia

- WI Wisconsin

- WY Wyoming

* State law permits surcharging for credit card purchases subject to specific disclosure requirements. State law permits a 2% threshold for credit card purchases.

** State law permits surcharging for credit card purchases subject to specific disclosure requirements. State law permits a 2.5% threshold for credit card purchases.

Surcharge Location Prohibitions in Canada

Quebec prohibits applying a surcharge fee for transactions made by shoppers based in Quebec.

Shopper Location Validation

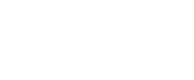

The location validation for your customers is based on country, state, and postal code values. For manually initiated payments through Payment Links, the address must be submitted by the customer on the checkout page. For auto payments, the address is taken from the address field of the default billing contact.

If your AR Automation account is connected to an accounting system, the default billing contact information is taken directly from the accounting system.

Address Value Validation

The value of the country field can be validated based on the country code. Refer to our list of countries with valid country codes here.

The value of the state field can be validated based on the state abbreviation. Refer to our list of countries with valid state abbreviations here.

Important

Make sure the address information for default billing contact is submitted in a valid format. If the shopper’s country, state, and/or postal code cannot be validated (i.e. submitted country/state value on the contact form is invalid), the surcharge fee won’t be calculated and added to the transaction amount. Additionally, if no address information is submitted for default billing contact, the surcharge fee won’t be applied to the original payment.

Displaying the Surcharge Fee

Payment Links

The surcharge fee value is displayed on the Payment Links as a separate line after submitting the billing address and card number. This means the customer will see the payment amount and surcharge fee before processing the payment. If the customer’s payment method or billing address is not allowed for surcharging, no fee accrual will be displayed.

Certain states, for example, New Jersey, require disclosure on the home page as well as the checkout page.

AR Account

The surcharge fee value is displayed on the Payment List page in a column named fee, as well as on the Payment Details page.

If no surcharge was applied, the fee field displays a $0.00 value, and hovering your mouse over the field will display the reason for the surcharge non-accrual.

Disclosures

The surcharge must be disclosed on the checkout page, indicating that a surcharge of x% will be applied for paying with a credit card. Depending upon the state, the surcharge disclosure may also need to be included on your home page (as per New Jersey requirements, for example). This means that if you plan to surcharge shoppers residing in New Jersey or if you are a merchant registered in New Jersey, please ensure you have a surcharge disclosure on your website's home page. Please see Surcharge Notice below to review the disclosure language.

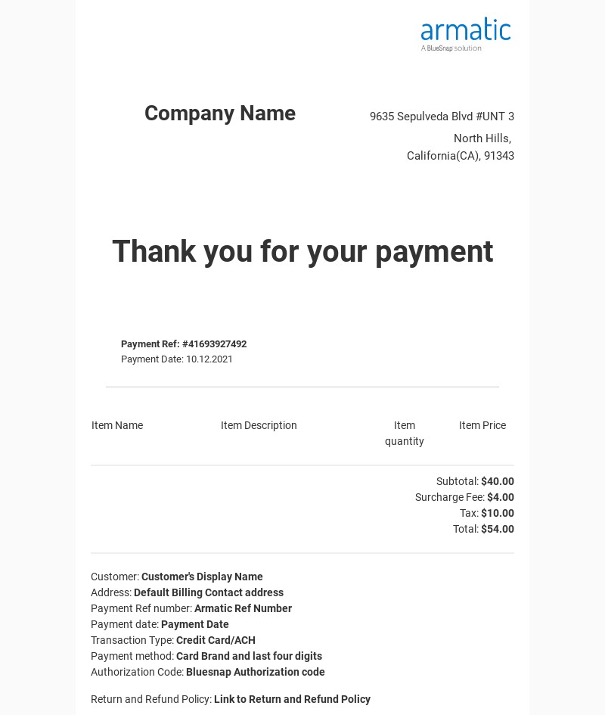

In addition, surcharges must be displayed as a separate line item on a receipt. If the surcharge is enabled on your account, we will add disclosure messages on the Payment Link and Pay Balance Link pages as well as on the checkout page where the shopper submits payment data.

Surcharge Notice

The surcharge notice below is added to the checkout page for transactions in the United States:

Surcharge Notice

We impose a surcharge of ____% on the transaction amount on Visa, MasterCard, AMEX and Discover credit card products, which is not greater than our cost of acceptance. We do not surcharge Visa, MasterCard, AMEX and Discover debit cards.

Additional disclosures for surcharging in certain states may apply. For example, Colorado requires specific language for a surcharge disclosure relative to the charge.

Disclosures for Auto Payments

The surcharge fee can be applied to auto payments, and it is important to make sure that your customers that have payments processed automatically are aware of the surcharge fee accrual.

We suggest two methods for informing your customers about surcharging:

- You may add the disclosure message to your default invoice terms field. (go to the Settings page > select Preferences > select the Invoices tab > fill in the Default Terms input field.

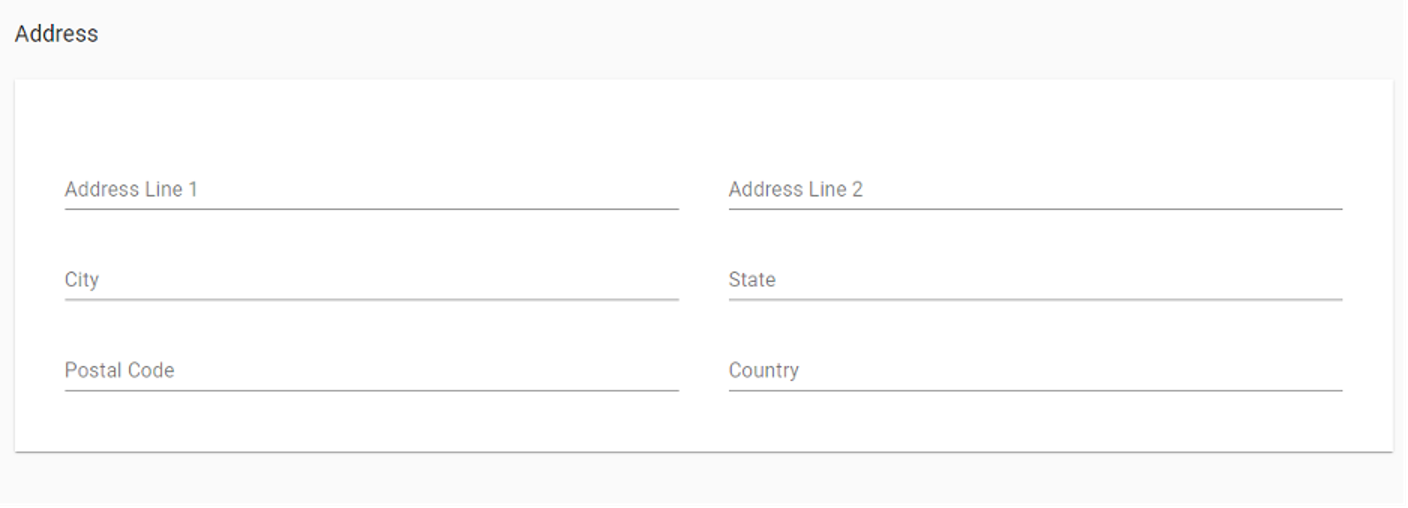

Note: The Default Terms field is displayed on the invoices created in AR Automation with one of the default invoice templates. If you are creating invoices in your accounting system and using an accounting system template, you need to make sure that you have the relevant invoice field in your accounting system where you can submit a disclosure message. - You can send an email or letter to notify customers prior to surcharging. You can create a cadence communication or manually send the email to each individual customer. The cadence step condition On a Particular Date is a good option for this.

Disclosure Message Requirements

You can use the same disclosure message as the one on your Payment Links, but it doesn’t have to be the same exact wording. Your shoppers must understand that they will be charged a surcharge fee and the cost of the surcharge fee. Disclosure requirements and sample compliant signage can be found here.

Auto Payment Cancellation

According to card brands' policies, merchants who surcharge must notify shoppers and must give them an opportunity to cancel payment before completing a purchase. If you have the surcharge setting enabled, your customers must be able to disable the auto payment setting through the Customer Portal.

Note

If the customer disables the auto payment setting on the Customer Portal, all scheduled auto payments for the customer will be canceled unless the customer re-enables the auto payment setting.

Surcharge Rate Value

The surcharge amount is variable and must be no greater than your average discount rate for that specific brand’s card transactions and cannot exceed certain thresholds, as defined by the card, country, and state law. In addition, the surcharge amount must be the same for all transactions from the card brands, regardless of the issuer and the card brand. The card brands require cards to be on a level playing field, with no competitive advantage due to different surcharge amounts amongst the card brands.

For example, if your discount rate is different for all card brands you are accepting, we will set the lowest rate as the surcharge fee rate for all card brands. If a merchant’s average discount rate is American Express 3%, Discover 2.5%, Mastercard 2%, and Visa 1.5% then the 1.5% for Visa would need to be applied to all brands. Our Implementation Team will help you determine your discount rate and set up the surcharge rate value. Please contact support by emailing [email protected].

Surcharge Rate Caps by Country

| Country | Maximum Allowable Credit Card Surcharge Rate |

|---|---|

| Australia | Must be capped at the processing cost of the card |

| Canada | 2.4% |

| United States (and territories) | 3% |

Card Brands Registration

If you wish to enable surcharging, you must notify Mastercard and BlueSnap of your intent to surcharge in writing, at least 30 days in advance of applying a surcharge. Our Implementation Team can assist you with the card brands surcharge registration process. Please contact support by emailing [email protected].

Refund and Return Policy

To comply with card brands' requirements, you must display links to your refund and return policies on the payment receipt. You can add the refund and return policy on the Preferences page, under Surcharge in the Refund and Return Policy field. Additionally, card brands require the surcharge or a prorated portion to be refunded with any return.

Payment Receipt

If you surcharge your customers, you should send a payment receipt to your customers that contains all payment data required by card brands. To be able to surcharge you must have the setting Send Payment Receipt enabled. You can turn on this setting by selecting the checkbox next to Send Payment Receipt on the Preferences page under Payments.

If the setting is enabled, AR Automation will send a payment receipt email for all payments processed through AR Automation. The email will be delivered to the default billing contact and all contacts with the setting Copy on messages enabled.

A payment receipt can be triggered for payments processed by CC, ACH, and SEPA only and is compatible with all card types. A payment receipt email can only be triggered for payments processed through AR Automation/BlueSnap.

Payment Receipt Mockup

Refunds and Surcharge

If you are processing a refund for a transaction with a surcharge fee accrued, the surcharge fee will be refunded accordingly. On a partial refund, the corresponding percentage of the surcharge fee will be returned to the customer.

Surcharge Enabling

The surcharge feature can be enabled/disabled on both the company and customer levels.

To enable/disable surcharging on a company level, please contact support by emailing [email protected] or contact your implementation engineer directly.

The surcharge fee rate must be set up by the AR Automation team as well. Please contact support or your implementation engineer.

To enable/disable surcharging on a customer level, go to Customer > Customer Record > enable/disable the Surcharge setting.

Passing Surcharge Value to BlueSnap Reports and Card Schemes

The surcharge fee value is passed to BlueSnap reports in metadata fields, so your reports will display new report columns reflecting the surcharge fee value. The data will be passed to BlueSnap with the following metafield values:

| Field | Value |

|---|---|

metaKey | Surcharge Applied |

metaValue | Fee Value (XXX) |

metaDescription | Surcharge Fee Amount |

Merchant Surcharge FAQs

Do I have to impose a surcharge?

No, it is entirely up to you whether or not to impose surcharge on payments.

Can I impose a surcharge on all payment methods?

It depends – certain countries may allow for surcharging on debit, credit, prepaid, and EFT. BlueSnap allows for surcharging only on debit, credit, and prepaid bank cards in Australia, with surcharges only on credit cards in the United States and Canada.

EFT Australia, Canada, and ACH transfers may have Surcharge applied.

Can I surcharge payments processed automatically by Auto Payment Rules?

Yes, but you must make sure that your customers are clearly informed about surcharging prior to the charge.

Do I need to inform all customers about imposing a surcharge?

Your customers must be aware of any surcharge. If surcharge is enabled for your AR Automation account, we must display a disclosure message on the Payment Link in order to comply with card brand regulations. The disclosure message states that the surcharge is only applicable to permitted card payments in that geography.

If you are going to run payments automatically with the surcharge fee, you may send over disclosure messages only to customers who have a payment method on file.

Updated 4 months ago